- Joined

- 21 December 2004

- Posts

- 674

- Reactions

- 1

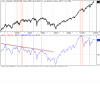

DTM said:XJO looks like its building to go up again. At the moment, its starting to move into overbought area and could be a weak movement up.

Next few days will tell whether its a weak movement up but up it is in my opinion.

OK, XJO seems to be in overbought country now and todays signal looks sickly.

Resource stocks looks sickly too. I'm in for BHP to go down short term ie next few days. I've been wrong before.