- Joined

- 8 June 2008

- Posts

- 14,055

- Reactions

- 21,152

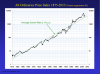

I see your point but your graph is based on a relatively short (aka a generation) timeline, where we had in the west the effect of a great age pyramid/demographicThere was an excellent podcast presentation on Andrew Swanscott's "Better System Trader" that mentioned the risk of NOT being in the market (some time ago - I'd have to dig back for the episode). Basically that over the long term the trend is up, albeit with some very inconvenient drawdowns along the way, such that a long term investor can't afford to risk not always having at least some size position in the market.

View attachment 70990 View attachment 70991

Now these inflated baby boomers number are going into spending more than saving, western world has reached a max in term of consumption capacity etc.I very doubt that these trends have any real meaning in the west; in the indonesian market or maybe indian market, yes but not here.people draw money when in pension more than they contribute, be it in their super or own investment, this new phase starts now!!!To the despair of our government pushing debt blindly to avoid the economical truth