You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WOW - Woolworths Group

- Thread starter Ko Ko

- Start date

- Joined

- 25 November 2008

- Posts

- 31

- Reactions

- 0

WOW - Woolworths, are they a good buy?

I've been thinking of buying Woolworths for a while now and have noticed that over the last week that they have dropped in price.

Does anyone have an opinion of Woolies? Is there any reason for their large drop last week?

I've been thinking of buying Woolworths for a while now and have noticed that over the last week that they have dropped in price.

Does anyone have an opinion of Woolies? Is there any reason for their large drop last week?

- Joined

- 25 November 2008

- Posts

- 31

- Reactions

- 0

Re: WOW - Woolworths, are they a good buy?

I think that I have just found out the answer. Saw the following on a news website:

Woolworths not buying JB Hi Fi

From: AAP

November 26, 2008

SUPERMARKET giant Woolworths says it has no intention of acquiring electronics retailer chain JB Hi-Fi.

Woolworths said today it was concerned about continued speculation regarding supposed offer discussions with JB Hi-Fi.

"Woolworths can confirm that it is not currently in discussions of any nature with JB Hi-Fi's board, management team, staff or advisers," Woolworths said in a statement.

Click here to read the full article on the website

Alternatively, you can copy and paste this link into your browser:

http://www.news.com.au/heraldsun/story/0,21985,24710382-664,00.html

I've been thinking of buying Woolworths for a while now and have noticed that over the last week that they have dropped in price.

Does anyone have an opinion of Woolies? Is there any reason for their large drop last week?

I think that I have just found out the answer. Saw the following on a news website:

Woolworths not buying JB Hi Fi

From: AAP

November 26, 2008

SUPERMARKET giant Woolworths says it has no intention of acquiring electronics retailer chain JB Hi-Fi.

Woolworths said today it was concerned about continued speculation regarding supposed offer discussions with JB Hi-Fi.

"Woolworths can confirm that it is not currently in discussions of any nature with JB Hi-Fi's board, management team, staff or advisers," Woolworths said in a statement.

Click here to read the full article on the website

Alternatively, you can copy and paste this link into your browser:

http://www.news.com.au/heraldsun/story/0,21985,24710382-664,00.html

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,440

- Reactions

- 11,854

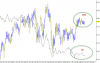

Seems to be heading back to this now established support area around $24 ish. $29 ish Great Wall of China. Hasn't held up as well as I would have thought and there's still some downside risk, but as others have said it's supposed to be a defensive stock and may be well liked when the tide turns and people start taking their money out from under the mattress.

Attachments

chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

"Seems to be heading back to this now established support area around $24 ish. $29 ish Great Wall of China. Hasn't held up as well as I would have thought and there's still some downside risk, but as others have said it's supposed to be a defensive stock and may be well liked when the tide turns and people start taking their money out from under the mattress."

That's a very scary looking head and shoulders pattern developing there Kennas.

That's a very scary looking head and shoulders pattern developing there Kennas.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,440

- Reactions

- 11,854

Yeah, we spotted that a while ago and mentioned it in the H&S thread I think. It actually broke down from that at $26 in July but miraculously recovered at $24. I'll take a stab and say that holds again. Or, it's off to .... golly where? $20 ish?"Seems to be heading back to this now established support area around $24 ish. $29 ish Great Wall of China. Hasn't held up as well as I would have thought and there's still some downside risk, but as others have said it's supposed to be a defensive stock and may be well liked when the tide turns and people start taking their money out from under the mattress."

That's a very scary looking head and shoulders pattern developing there Kennas.

Almost looks like it has not performed for the H&S have never seen a H&S fail after the neckline has been broken but have read about it happening. The current rally after breaking a trendline going back to 2000 has been straddling it on both sides for a short while currently below. The look of the rally is corrective and on balance volume is below its trend line. the next week will be interesting and as I'm short either profitable or slightly not.

Attachments

- Joined

- 28 March 2007

- Posts

- 28

- Reactions

- 0

Woolies continues to make noise a potential entrance into the Indian grocery market. The latest story sees them hooking up in joint venture with Pantaloon (on top of their existing Tata/Dick Smith tie in). See:

http://internationalbs.wordpress.com/2008/12/16/the-woolies-indian-adventure-a-follow-up/

Interesting times...

http://internationalbs.wordpress.com/2008/12/16/the-woolies-indian-adventure-a-follow-up/

Interesting times...

- Joined

- 28 March 2007

- Posts

- 28

- Reactions

- 0

And an earlier discussion of their Indian aspirations:

http://internationalbs.wordpress.co...-an-indian-prizewoolies-eyes-an-indian-prize/

http://internationalbs.wordpress.co...-an-indian-prizewoolies-eyes-an-indian-prize/

- Joined

- 28 March 2007

- Posts

- 28

- Reactions

- 0

And a new post chronicling the experiences of the different Woolworths around the globe:

http://internationalbs.wordpress.co...e-woolies-a-gratutious-business-history-post/

http://internationalbs.wordpress.co...e-woolies-a-gratutious-business-history-post/

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,440

- Reactions

- 11,854

Recovered ok from the $23 lows and proving to be some sort of safe haven status. Bit of support built up around $25. Just ambling sideways for the moment really until $29 broken perhaps. Wonder how it'll go once the next bottom is found and the market starts to really consolidate and perhaps restart upward movement. Whenever that is...

Attachments

- Joined

- 28 March 2006

- Posts

- 3,567

- Reactions

- 1,310

They are reporting this week, 27th I think, got a feeling it may be good.

Volume is up with the price today.

Volume is up with the price today.

They are reporting this week, 27th I think, got a feeling it may be good.

And when is it not?

WOW has to be the ultimate defensive growth stock of our market.

I'm still looking for a "dip" to buy it in!

Disc: Not holding, wish I were.

- Joined

- 28 March 2006

- Posts

- 3,567

- Reactions

- 1,310

And when is it not?

WOW has to be the ultimate defensive growth stock of our market.

I'm still looking for a "dip" to buy it in!

Disc: Not holding, wish I were.

Bar chart is WOW and the line overlay is the ASX 200 (XJO) index.

Looks like they are parting ways.

(click to enlarge)

Attachments

- Joined

- 8 January 2009

- Posts

- 56

- Reactions

- 0

What the hell is wrong with the market? Woolworths announces its half year results which include a 10.3% increase in net profit and a 9.1% increase on the interim dividend and it gets sold off? I know they've been doing even better than this in the past and expectations were high but how could you complain about this kind of growth in these times?

And when is it not?

WOW has to be the ultimate defensive growth stock of our market.

I'm still looking for a "dip" to buy it in!

Disc: Not holding, wish I were.

Here's your opportunity

What the hell is wrong with the market? Woolworths announces its half year results which include a 10.3% increase in net profit and a 9.1% increase on the interim dividend and it gets sold off? I know they've been doing even better than this in the past and expectations were high but how could you complain about this kind of growth in these times?

WOW is trading at a premium, for a PE of 18 I expect earning need to grow at least 12% a year to even come close to justify with that sort of price...there is more down side to WOW than upside.. in the next few years I think it will run out of puff and start to take risky decision..right now they are on that way already going into NZ when it's not profitable for them to do so...

I like WOW a lot but I dont like the price so just sit and wait till the day

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

I sold all my stocks bar WOW and a couple of others in January 2008. Occasionally I do the calculation to show how far down I'd have been had I not done this. It's a pleasant exercise.

In July 2008 I sold the WOW also to protect profits.

Now I wish I'd held on to it, as it's about $3 above my sell price.

Agree that it's the ultimate defensive stock.

Re the PE, there are times when a higher PE is completely justified.

In July 2008 I sold the WOW also to protect profits.

Now I wish I'd held on to it, as it's about $3 above my sell price.

Agree that it's the ultimate defensive stock.

Re the PE, there are times when a higher PE is completely justified.

- Joined

- 5 February 2009

- Posts

- 22

- Reactions

- 0

What the hell is wrong with the market? Woolworths announces its half year results which include a 10.3% increase in net profit and a 9.1% increase on the interim dividend and it gets sold off? I know they've been doing even better than this in the past and expectations were high but how could you complain about this kind of growth in these times?

I agree, (plus add on 7,000 new jobs) from what I read, the analysts were upset that WOW only made $983M, give or take a $, and they were expecting $1B plus. So, for $17M, they weren't happy and it got marked down.

I laughed, in a sad, remorseful way.

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

I agree, (plus add on 7,000 new jobs) from what I read, the analysts were upset that WOW only made $983M, give or take a $, and they were expecting $1B plus. So, for $17M, they weren't happy and it got marked down.

I laughed, in a sad, remorseful way.

Also a company with a solid number of employees who hold stock. Always helpful!

But I tend to think it may go a little lower yet.

Similar threads

- Replies

- 1

- Views

- 1K

- Replies

- 12

- Views

- 3K

- Replies

- 31

- Views

- 4K