You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

When does the yield on US Treasuries blow out?

- Thread starter Bushman

- Start date

- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

Its easy to me - those countries need the US to recover in the short-term. It is the great nation-building game -

1. Make cheap white goods to sell to the US consumer;

2. Increase foreign currency reserves;

3. Use foreign currency to buy US-gov't treasuries;

4. Treasuries used to build money supply in the US, ending up as debt in the pocket of the American consumer.

5. Repeat ad infinitum.

So those foreign debtors needs 'Joe Average' to be under the illusion that increased money supply is actually wealth in his pocket, meaning he will buy the tripe that is fuelling the third world's nation building.

This is what pulled Japan out of being bombed into oblivion after all - selling consumer trinkets to the Yanks. When they became 'wealthy', they passed the industrial baton to the Chinese.

Question is, what happens when China becomes 'wealthy' (assuming resources don't run out in the process)? Maybe the baton will then pass to the Africans?

Fantastic post Bushman. Spot on!

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

We're all blowing bubbles (West Ham fans would understand).

Anyway Clinton has urged China to keep buying treasuries i.e. fund their number one customer, the US consumer. It is, after all, a symbiotic relationship. Wonder if the Chinese still buy it (pardon the pun).

Cut the chord and the scam might be up. Then watch out as the new US Marine Corp, the 59th Airborne printing presses, try to inflate China and Japan's foreign currency 'reserves' to kingdom come.

Popcorn anyone?

From Marketwatch: Clinton urges China to keep buying U.S. debt

Reports: On first state visit, Clinton highlights U.S.-China interdependence

By MarketWatch

Last update: 4:29 p.m. EST Feb. 22, 2009Comments: 129SAN FRANCISCO (MarketWatch) -- Secretary of State Hillary Clinton wrapped up a state visit to China Sunday by urging her hosts to continue to invest in U.S. Treasury instruments and underscoring the two countries' interdependence, according to published reports.

Anyway Clinton has urged China to keep buying treasuries i.e. fund their number one customer, the US consumer. It is, after all, a symbiotic relationship. Wonder if the Chinese still buy it (pardon the pun).

Cut the chord and the scam might be up. Then watch out as the new US Marine Corp, the 59th Airborne printing presses, try to inflate China and Japan's foreign currency 'reserves' to kingdom come.

Popcorn anyone?

From Marketwatch: Clinton urges China to keep buying U.S. debt

Reports: On first state visit, Clinton highlights U.S.-China interdependence

By MarketWatch

Last update: 4:29 p.m. EST Feb. 22, 2009Comments: 129SAN FRANCISCO (MarketWatch) -- Secretary of State Hillary Clinton wrapped up a state visit to China Sunday by urging her hosts to continue to invest in U.S. Treasury instruments and underscoring the two countries' interdependence, according to published reports.

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

So stop buying them and let this market correct Wen Jiabao.

I read somewhere that the US has to sell $60b of treasuries a day to fund the stimulus package. Big bickies. Who buys them if China scales back and at what yield? What then for the bail out?

Watching with interest.

The Age:

China seeks assurances on US debtMarch 13, 2009 - 4:35PM Page 1 of 2 Single page view

China, the US government's largest creditor, is ''worried'' about its holdings of Treasuries and wants assurances that the investment is safe, Premier Wen Jiabao said.

''We have lent a huge amount of money to the United States,'' Wen said at a press briefing in Beijing today after the annual meeting of the legislature. ''Of course we are concerned about the safety of our assets. To be honest, I am a little bit worried. I request the US to maintain its good credit, to honor its promises and to guarantee the safety of China's assets.''

I read somewhere that the US has to sell $60b of treasuries a day to fund the stimulus package. Big bickies. Who buys them if China scales back and at what yield? What then for the bail out?

Watching with interest.

The Age:

China seeks assurances on US debtMarch 13, 2009 - 4:35PM Page 1 of 2 Single page view

China, the US government's largest creditor, is ''worried'' about its holdings of Treasuries and wants assurances that the investment is safe, Premier Wen Jiabao said.

''We have lent a huge amount of money to the United States,'' Wen said at a press briefing in Beijing today after the annual meeting of the legislature. ''Of course we are concerned about the safety of our assets. To be honest, I am a little bit worried. I request the US to maintain its good credit, to honor its promises and to guarantee the safety of China's assets.''

So stop buying them and let this market correct Wen Jiabao.

I read somewhere that the US has to sell $60b of treasuries a day to fund the stimulus package. Big bickies. Who buys them if China scales back and at what yield? What then for the bail out?

Watching with interest.

The Age:

China seeks assurances on US debtMarch 13, 2009 - 4:35PM Page 1 of 2 Single page view

China, the US government's largest creditor, is ''worried'' about its holdings of Treasuries and wants assurances that the investment is safe, Premier Wen Jiabao said.

''We have lent a huge amount of money to the United States,'' Wen said at a press briefing in Beijing today after the annual meeting of the legislature. ''Of course we are concerned about the safety of our assets. To be honest, I am a little bit worried. I request the US to maintain its good credit, to honor its promises and to guarantee the safety of China's assets.''

The weekly auction is currently $60bn additional bonds on what was already being auctioned, not per day.

There is a pool of bidders, and I am pretty sure bidding is compulsory to be part of the pool.

http://www.federalreserve.gov/monetarypolicy/taf.htm

Results of the latest auction

http://www.federalreserve.gov/monetarypolicy/20090310b.htm

Bid/cover ratio 0.79

From wikipedia

The higher the ratio, the higher the demand. A ratio above 2.0 indicates a successful auction comprised of aggressive bids. A low ratio is an indication of a disappointing auction, marked by a wide bid-ask spread.

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

The weekly auction is currently $60bn additional bonds on what was already being auctioned, not per day.

There is a pool of bidders, and I am pretty sure bidding is compulsory to be part of the pool.

http://www.federalreserve.gov/monetarypolicy/taf.htm

Results of the latest auction

http://www.federalreserve.gov/monetarypolicy/20090310b.htm

Bid/cover ratio 0.79

From wikipedia

Cheers for that.

$60b a day - must've be a case of Chinese whispers?

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

I think this author is better than most. Here is an interesting synopsis on the China:US arm wrestle.

As an aside, Peter Navarro is also long Dupont and GE (which he terms a 'call option').

'China Embarrasses the United States

With China holding about $2 trillion of American assets, they should be rightly concerned about the value of those assets. It was embarrassing for the United States, nonetheless, for the Chinese Premier Wen Jiabao to publicly question the solvency of the US government. That is precisely the kind of embarrassment the US is likely going to have to get used to until our government gets off its knees and stops begging for Chinese money to pay for its budget and trade deficits.

In many ways, however, it is a delicious dilemma that the United States now puts China in. If China refuses to keep buying our bonds, the value of the dollar will plunge, and so, too, will the value of China's foreign reserves held in dollars.

On the other hand, if China keeps buying our debt to prop up the dollar, it faces a strong likelihood that with so much fiscal stimulus and easy money coursing through the US system, inflation is all but inevitable. That, too, will ultimately devalue the dollar and therefore Chinese foreign reserves. So, for the Chinese, the question is whether to cut and run now or hold on and be scalped later. Of course, the problem with the United States getting the last laugh on the Chinese is that it's predicated on turning our currency into worthless paper. Stay tuned!'

From the following on-line article:

www.financialsense.com/editorials/navarro/2009/0316.html

As an aside, Peter Navarro is also long Dupont and GE (which he terms a 'call option').

'China Embarrasses the United States

With China holding about $2 trillion of American assets, they should be rightly concerned about the value of those assets. It was embarrassing for the United States, nonetheless, for the Chinese Premier Wen Jiabao to publicly question the solvency of the US government. That is precisely the kind of embarrassment the US is likely going to have to get used to until our government gets off its knees and stops begging for Chinese money to pay for its budget and trade deficits.

In many ways, however, it is a delicious dilemma that the United States now puts China in. If China refuses to keep buying our bonds, the value of the dollar will plunge, and so, too, will the value of China's foreign reserves held in dollars.

On the other hand, if China keeps buying our debt to prop up the dollar, it faces a strong likelihood that with so much fiscal stimulus and easy money coursing through the US system, inflation is all but inevitable. That, too, will ultimately devalue the dollar and therefore Chinese foreign reserves. So, for the Chinese, the question is whether to cut and run now or hold on and be scalped later. Of course, the problem with the United States getting the last laugh on the Chinese is that it's predicated on turning our currency into worthless paper. Stay tuned!'

From the following on-line article:

www.financialsense.com/editorials/navarro/2009/0316.html

Hi guys,

Yes yes this is the same thing everyone has commented on.

I would like to raise a quick point.

The USD has been falling slowly in value for years now (thanks to long everything/short USD plays) and the Chinese were holding one of the worlds largest USD longs when it looked more like continued long-term devaluation and they still held and added to it.

The financial crisis has wiped out all their losses since 2005 or something and very nice gains on anything they bought as recently since 2006ish! They are now doing what any big player does and sells slowly into this strength.

Do you see my point?

They are not worried about the devaluation of their USD 2tr holdings through inflation or debt default.

They are more worried the US will beat them to the punch and devalue the USD significantly before they can devalue their currency against the USD (or otherwise wipe out any devaluations they make)!

Which is why they will keep eating the debt for as long as they can.

Yes yes this is the same thing everyone has commented on.

I would like to raise a quick point.

The USD has been falling slowly in value for years now (thanks to long everything/short USD plays) and the Chinese were holding one of the worlds largest USD longs when it looked more like continued long-term devaluation and they still held and added to it.

The financial crisis has wiped out all their losses since 2005 or something and very nice gains on anything they bought as recently since 2006ish! They are now doing what any big player does and sells slowly into this strength.

Do you see my point?

They are not worried about the devaluation of their USD 2tr holdings through inflation or debt default.

They are more worried the US will beat them to the punch and devalue the USD significantly before they can devalue their currency against the USD (or otherwise wipe out any devaluations they make)!

Which is why they will keep eating the debt for as long as they can.

Guys you should not associate treasury yield blow out with the USD crashing and gold prices rising. Because there is a good chance the opposite will happen. USD will sky rocket as USD debts need to be quickly repaid in the high interest rate environment. Gold will become worthless because it has no real utility value.

- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Guys you should not associate treasury yield blow out with the USD crashing and gold prices rising. Because there is a good chance the opposite will happen. USD will sky rocket as USD debts need to be quickly repaid in the high interest rate environment. Gold will become worthless because it has no real utility value.

Maybe, but gold is real & physical & not an arbitrary limitless creation which relies on trust between the counterparties, the emphasis being on limitless as in Great Britain printing the stuff already!

You could get to the point where even a high interest rate will not be enough to entice creditors to lend the US money if there is the possibility of not getting any back? So you get rates going up but the currency going down at the same time? Latest reports suggest there is a net outflow now out of US instruments - last one out turn the lights off

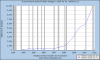

Parabolic debt is unsustainable - the outcome is inevitable, only the timing is unknown..........

Attachments

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

LOL; never bet against the US Treasury in the fight against 'evil' deflation? Might have to wait a bit longer now but it is a bit like the Kremlin buying roubles at the moment. Isn't it, isn't it? Takes his bat and ball and goes fishing.

Quote that comes to mind: 'reports of my death have been greatly exaggerated'. Lol

From Marketwatch:

BOND REPORT

Treasurys skyrocket as Fed set to buy U.S. debt

Yields reverse all of 2009's climb

By Deborah Levine, MarketWatch

Last update: 3:45 p.m. EDT March 18, 2009Comments: 51NEW YORK (MarketWatch) -- Treasury prices soared Wednesday, sending yields plummeting by the largest amount since 1987 after the Federal Reserve surprised bond investors by saying it would buy $300 billion in longer-term Treasury securities over the next six months.

Yields on the benchmark 10-year note , which move in the opposite direction from their prices, declined 50 basis points to 2.52%, the biggest drop since the stock market crashed in October 1987.

Quote that comes to mind: 'reports of my death have been greatly exaggerated'. Lol

From Marketwatch:

BOND REPORT

Treasurys skyrocket as Fed set to buy U.S. debt

Yields reverse all of 2009's climb

By Deborah Levine, MarketWatch

Last update: 3:45 p.m. EDT March 18, 2009Comments: 51NEW YORK (MarketWatch) -- Treasury prices soared Wednesday, sending yields plummeting by the largest amount since 1987 after the Federal Reserve surprised bond investors by saying it would buy $300 billion in longer-term Treasury securities over the next six months.

Yields on the benchmark 10-year note , which move in the opposite direction from their prices, declined 50 basis points to 2.52%, the biggest drop since the stock market crashed in October 1987.

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

Hi Bushman,

I predicted massive bond strength over a week ago in the gold thread by comparing 30y yield and gold price decline.

If it's ok with you I will steal your posted article to paste there for the purposes of unseemly gloating

Go for it my learned friend - give those militia men hell; lol!!

Gold is up, yields should price this in soon.

Here is Yves Smith, a must read for anyone in or interested in the bond market.

http://www.nakedcapitalism.com/2009/03/on-feds-shock-and-awe.html

Comes with all the good numbers and inside scoop.

I will include this snippet which she has quoted from the "Report to the Secretary of the Treasury from the Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association" (link included inside the blog post)

Here is Yves Smith, a must read for anyone in or interested in the bond market.

http://www.nakedcapitalism.com/2009/03/on-feds-shock-and-awe.html

Comes with all the good numbers and inside scoop.

I will include this snippet which she has quoted from the "Report to the Secretary of the Treasury from the Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association" (link included inside the blog post)

The net supply of Treasurys in 2009 and 2010 combined seems likely to total more than $3 trillion and could climb as high as $4 trillion. The Congressional Budget Office (CBO) estimates the 2009 Federal budget deficit to be $1.2 trillion. The consensus of private sector analysts is similar to that figure. Yet, neither the CBO estimate nor the private consensus reflect fully the funding needs associated with the Obama Administration's fiscal stimulus plans, the implementation of TARP (or another TARP-like program), or the rumored creation of a bad/aggregator bank to help deal with the underperforming assets weighing down financial institutions. Some of the funding of these government programs will spill over into 2010, a year in which the "core" budget position also will be weak according to mainstream expectations for economic performance.

Actual and potential funding needs for financial sector stabilization programs already announced are considerable. Guarantees made on select assets of systemically critical financial institutions could require Treasury to raise hundreds of billions of dollars in the event that these assets continue to deteriorate. Similarly, guarantees made by the FDIC on select bank-issued debt could catapult government borrowing needs further should the issuing bank(s) default on its FDIC-insured paper. Any additional guarantees on future losses to assets held by financial institutions would further increase net borrowing needs by Treasury. The size of any such borrowing would hinge on the type and size of assets backstopped.

The expansion in quasi-government paper contributes to the risk of market saturation. Banks have issued nearly $150 billion in FDIC-backed paper since the programs introduction. Spreads on this paper have been narrowing over time with the latest deal, paper offered by Citi, pricing just 30 basis points over Libor. Real money investors have purchased the bulk of this paper in an attempt to pick up yield over Treasurys while not taking on additional credit risk. In some respects, this paper has replaced GSE debt as the instrument of choice for real money investors looking for modestly higher yielding, quasi-government debt.

"Foreign demand for long-term Treasuries has disappeared over the last few months," writes Brad Setser - an ex-US Treasury and IMF official, former economist for Nouriel Roubini's doom-and-gloom funsters at RGE Monitor, and a visiting or associate fellow pretty much everywhere worth having deep thoughts on big subjects.

Studying the latest official data (released Monday) in his blog for the Council on Foreign Affairs, "It is striking that for all the talk of safe haven flows to the US, foreign demand for all long-term US bonds has effectively disappeared," he explains.

In particular, "Over the past three months, almost all the growth in China's Treasury portfolio has come from its rapidly growing holdings of short-term bills, not from purchases of longer-term notes...and it is also still selling [mortgage] Agency bonds."

All told, China continued to buy US Treasury debt; it is "the only option" for China, Russia and everyone else at this stage of the game, as Luo Ping wailed to the FT last month. But of the $12.2 billion China purchased in January, fully 95% were short-term bills. "Russia also, interestingly, added to its holdings of short-term Treasury bills," Setser says.

And then, with the latest Treasury fund-flow data revealed...BOOM! The Federal Reserve prints $300bn to buy 30-year US debt, plus another $750bn to buy mortgage-agency bonds.

A snippet by Adrian Ash.

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

May 2009!

- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

May 2009!

Reality has set in hey.

Now we have a falling USD, rising equity markets and rising gold. WTF?

Gold becoming a pure USD hedge it appears, with a move from financial assets (bonds), into hard assets (metals, energy).

- Joined

- 6 June 2007

- Posts

- 1,314

- Reactions

- 10

Now we have a falling USD, rising equity markets and rising gold. WTF?

Gold becoming a pure USD hedge it appears, with a move from financial assets (bonds), into hard assets (metals, energy).

The drums are now beating well and truely for USD inflation - treasuries tell us that, bonds tell us that, commodities tell us that and gold tells us that.

US has to inflate itself out of this banking mess. It is that or it is 'change the game' and that ain't in the Americans best interests (the game being set up for the US to live of the fat of the land). At least we no longer have to hear tired comparisons to the Great Depression anymore.

PS: thank god Barca won the Champions League hey. What a great team. Iniesta for FIFA Player of the Year next year.

I think it's a mistake to look at short term market movements and speculative oil/metals bubbles and conclude that inflation is dominant. Massive deflationary forces are still with us: rising debt, rising interest payments, rising debt default, falling real estate prices and the mountain of US mortgage resets still to come.

IMHO, it's too early to conclude that we will avoid a great depression experience.

IMHO, it's too early to conclude that we will avoid a great depression experience.

Similar threads

- Article

- Replies

- 2

- Views

- 1K