- Joined

- 5 April 2014

- Posts

- 26

- Reactions

- 0

Interesting discussion guys, so keep it going (despite some contradictory suggestions (hold onto losers to turn it to winners vs close out losing position strictly etc ))

))

Trading shares long only without a trailing stop.

1 position - maximum loss is 100%

1 position - maximum profit is infinity

The same with a stop

1 position - maximum loss is < 100%

1 position - maximum profit is still infinity

Interesting discussion guys, so keep it going (despite some contradictory suggestions (hold onto losers to turn it to winners vs close out losing position strictly etc))

Why else do you, or others, do this?

The stock market is in a permanent uptrend. Has been for 200 years.

That's why a portfolio of 20-odd stocks with a trailing stop is profitable. It won't work with 1 stock. You need 20-odd, appropriately position sized.

Limits the downside.

Doesn't limit the upside.

Individual stocks can go to zero.

A diversified portfolio won't.

A trailing stop can be almost anything, so long as the winners are allowed to run and the losers are limited in some way. It can be technical, it can be fundamental, it can be astrological. It can even be zero.

You go on to suggest that it would work for a portfolio of 20 such stocks and applying this strategy. It actually doesn't.

You are clearly experienced and it is very nice to correspond with someone whose actually been around a bit. If I may, where/how did you learn to apply stop losses? Why did you find the concept attractive from a psych viewpoint?

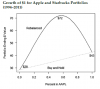

We'd have to agree to disagree on the value of a trailing stop. All the extensive backtesting I did way back in the past confirmed a dramatically improved result when a stop loss was applied.

Where did I adopt the practice of using a stop loss? I'd say I picked it up from several of the trading books I read early on and then verified what it did with a lot of backtesting.

I don't find the concept attractive psychologically. I hate a 40% win rate. I am, however, still in the game despite only trading long with copious leverage during the GFC. I also have a portfolio that traded exactly as suggested by backtesting - a string of small losses to begin with, and now almost everything I hold is hugely profitable.

In short - it has worked for me as I expected it to.

Hit stop -> close position.When you conducted your backtest...what did you code for the action taken subsequent to hitting a stop?

In the same stock? With equivalent size? With no delay?Hit stop -> close position.

Open another.

In the same stock? With equivalent size? With no delay?

No, in a different stock.

Sell the downtrending one.

Buy an uptrending one.

Position size is 0.5% risk so depends on where the stop is and on overall capital.

Interesting discussion guys, so keep it going (despite some contradictory suggestions (hold onto losers to turn it to winners vs close out losing position strictly etc))

Watching this thread with interest.

2 opposing views.

A sell winners add to losers, ie re-balance.

B sell losers add winners (stocks in uptrend).

Both will work with the correct stocks.

Consider A, in a market decline where everything is going down (ie 2008), re-balancing gives more money to the biggest losers from the smallest losers.

Consider B all stocks get sold, stay in cash until market turns.

I prefer B, did B in 2008. From trading a 6 figure sum, lost less than interest for year.

I add to winners not losers, seems the opposite of most people.

Love Ed Seykota's rules.

1. Cut losses. 2. Ride winners. 3. Keep bets small. 4. Follow the rules without question. 5. Know when to break the rules.

Every stock is different.

Retired Young, you seem to be on a crusade to have everyone re-balance, why?

Hi Brty and also Burglr ...

just continuing the dialogue!

... There are buyers and sellers. They move prices RELATIVE to one another. It doesn't matter what their motivations are. They could be buying on expectations of a rise, trimming their portfolio despite continuing to anticipate a rise, market making, redeeming to fund a $30pa budget requirement ...

... Hope that helps ...

Read more:“The stock market by its very nature is designed for you to lose money. The rallies and reactions within any trend ensure this process is at work constantly. It is created automatically. The market behaves this way because it has to! The weak have to perish so that the strong can survive. Professional traders are fully aware of the weaknesses in traders under stress and will capitalise on this at every opportunity.”

If you don't rebal, you can never profit from the times when the wiggling brings the weights closer to the initial weights...when the portfolio reverts. Rebalancing prior to reversion will always make you money (prior to t-cost). You are buying low and selling high. Or selling high and buying low. Rebalancing or not rebalancing for the Up-Up and Down-Down scenarios produce the same expected returns. The expected return for Up-Up and Down-Down are the same in combination, so any weighting scheme you come up with produces identical outcomes in expectations. In this case the weighting schemes are whatever the drifted portfolio has become, and the rebalanced portfolio weights (the initial weights).

So, if you rebal, every time the portfolio reverts, you make money. Buy-hold never grabs this. If the portfolio does not revert, you are no worse off than buy-hold. Hence, as time passes and the portfolio wiggles around, coins just appear and fill your money jar.

Each stock can be assumed to just drift upwards, but wiggles along on its path.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.