- Joined

- 5 April 2014

- Posts

- 26

- Reactions

- 0

Hi guys,

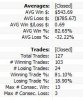

I have a question from experienced punters or investors. I am just wondering what has your hit and miss ratio been since you have started punting/investing on stocks. I am just wondering if it is possible to keep hit ratio over 50% in the long term. What I am saying is how many times you call turned out to be right compared to total call (including wrong call) for each specific time frame target?

Cheers

I have a question from experienced punters or investors. I am just wondering what has your hit and miss ratio been since you have started punting/investing on stocks. I am just wondering if it is possible to keep hit ratio over 50% in the long term. What I am saying is how many times you call turned out to be right compared to total call (including wrong call) for each specific time frame target?

Cheers