Is there any evidence that moving an initial stop point to B/E actually "increases" gains simply because it makes a given trade a no loss trade?

For eg. Who is to say that if the original stop had been left in place, (and just missed being taken out) that the trade may not have continued on for a 2,3 or 4R winner ............

Hi Barney,

None of my discussions talked specifically about moving the stop to B/E only about reducing the risk of the trade once I have entered.

For me it depends on what market I'm trading and over what time-frame.

When trading the SPI on 1min bars I will move the stop to b/e as soon as possible - sometimes when the trade has only moved 2-3 points in my favour. My testing has shown that this dramatically improves my overall profitability in this market on this time-frame for a number of reasons.

But....

When trading ASX shares on EOD charts my techniques change to suit the market and type of set up I'm trading.

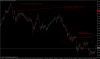

For instance I have one particular set up that once the trade is triggered if price reverses after my entry and then reverses again and manages to break back through the entry level I know that if price comes back and breaks that latest low, price then has around a 90% chance of either flopping around doing nothing or taking out my original stop, either way I know do not want to be in the trade anymore once that level is breached so that is where my stop is moved to. On average this level is somewhere around 50%-75% of my original stop, so I can therefore move my stop and reduce the risk of the trade without affecting the winning potential.

There are times when both these methods might cost me a profitable trade by stopping me out early but there are also plenty of times these methods have saved my full stop being hit which in the long run makes me more money then allowing my full stop to be hit.

The way I look at it is one less dollar I lose by controlling my risk once in a trade is one less dollar I have to make back to be profitable. The majority of my trading is solely about controlling my loses so when I have that good day, week or month I'm not just making back my losses.

This is where I believe the difference between theory and application comes in. A experienced successful trader learns the hard way that protecting capital is the key to longevity in the markets, there are times when conditions suit and there is plenty of money to be made but the majority of time it is about protecting capital and reducing loses - treading water really, so when the good times come you can take full advantage of it.