Week 36

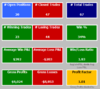

Buy: 12 buys

Sell: 1 stale exit

Index is up. The XAO gained a lot this week. According to my spreadsheet I gained 3%. Not bad since I'm only 25% invested.

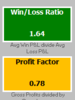

According to my current spreadsheet I'm at -3.06% but according to Share Trade Tracker I would be out of drawdown. Something to look into. I'm thinking of changing to Share Trade Tracker but its limited in charts. I would love some different charts and the ability to track my progress against the XAO like I currently do. I'm not sure how @Skate has weekly results showing in his charts too.

Buy: 12 buys

Sell: 1 stale exit

Index is up. The XAO gained a lot this week. According to my spreadsheet I gained 3%. Not bad since I'm only 25% invested.

According to my current spreadsheet I'm at -3.06% but according to Share Trade Tracker I would be out of drawdown. Something to look into. I'm thinking of changing to Share Trade Tracker but its limited in charts. I would love some different charts and the ability to track my progress against the XAO like I currently do. I'm not sure how @Skate has weekly results showing in his charts too.