You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Weekly Portfolio - ASX

- Thread starter Warr87

- Start date

-

- Tags

- trend weekly trading

Bad day for the market, though I stayed in positive territory! always good  .

.

Today marked the start of my super portfolio. i opened an account with market access to the ASX300. i bought Radge's large cap momentum code and changed a few settings. i will post my results on this, likely in a separate thread. but it's monthly, so not a lot to really keep people engaged. will be slow!

in other news. i finally released some money from some managed funds i invested in 2 years ago. this means my MAP strategy will have double the funds. i will have some left over for a small daily trading strategy as well but that is still going through backtesting/papertrading and probably will be for at least 3 months.

Today marked the start of my super portfolio. i opened an account with market access to the ASX300. i bought Radge's large cap momentum code and changed a few settings. i will post my results on this, likely in a separate thread. but it's monthly, so not a lot to really keep people engaged. will be slow!

in other news. i finally released some money from some managed funds i invested in 2 years ago. this means my MAP strategy will have double the funds. i will have some left over for a small daily trading strategy as well but that is still going through backtesting/papertrading and probably will be for at least 3 months.

interesting week. even on the days when the market lost I still gained a little. it was all wiped out today though. i'm sure i'm not alone.

my system is also giving me the index down. my index filter is set to 10weeks. this means i'll be shedding a lot of positions. honestly my temptation is to fiddle with the filter so i can keep trading ... but i will resist.

a proper update to come.

my system is also giving me the index down. my index filter is set to 10weeks. this means i'll be shedding a lot of positions. honestly my temptation is to fiddle with the filter so i can keep trading ... but i will resist.

a proper update to come.

- Joined

- 12 January 2008

- Posts

- 7,365

- Reactions

- 18,408

Looks like this system trader is doubting his system. IMO an index filter is a real tricky thing to include in a momentum trading system. The main reason is deciding what parameters to use with the index. If the period is too small then one down week can turn it off. This gets us out of the market quickly but this may be premature and triggered by what turns out to be a normal dip in a bullish market. If the parameter is too long, then we lose too much of our open profit and we're late into the next bullish rally.

The system trades bullish momentum in individual stocks. Stocks most in demand start moving first and it's their movement that causes the index to move. Stocks make the index move, yet in our mom system we place the cart before the horse and wait for the index to move before trading individual stocks. It doesn't make sense (to me).

I was never comfortable with any parameter I chose for the index and that's why my index filter doesn't turn the trading system off/on. I use it as a warning indicator to reduce/increase portfolio heat. @rnr made a valuable comment that his index filter indicates which setups to use.

I've no doubt that your (@Warr87 ) portfolio holds many positions that are losing money. Why don't you sell all the biggest losers when the index filter triggers this action. Then if the market goes further down exit all (GTFO exit). If the market rallies (just an ugly dip) then you're still partially invested and have capital to buy the stronger stocks.

I understand that you can't make any changes without testing and I agree this is the correct course of action. I also know that discretionary ideas are also very hard to code. The ideas that I've suggested CAN be coded if you think they have potential to improve performance.

It's times like these that I wish I could show you with back testing results how valuable these ideas are. I've only got 15 years trading experience to know that they are.

@Skate 's stale exit is only one way a portfolio can be kept in the strongest momentum moves. Selling the weakest stocks first at the early signs of market bearishness is another way.

Rotational momentum systems always ensure the portfolio is filled with the strongest movers. They cull the slowest movers in the portfolio (even if price is going up).

The system trades bullish momentum in individual stocks. Stocks most in demand start moving first and it's their movement that causes the index to move. Stocks make the index move, yet in our mom system we place the cart before the horse and wait for the index to move before trading individual stocks. It doesn't make sense (to me).

I was never comfortable with any parameter I chose for the index and that's why my index filter doesn't turn the trading system off/on. I use it as a warning indicator to reduce/increase portfolio heat. @rnr made a valuable comment that his index filter indicates which setups to use.

I've no doubt that your (@Warr87 ) portfolio holds many positions that are losing money. Why don't you sell all the biggest losers when the index filter triggers this action. Then if the market goes further down exit all (GTFO exit). If the market rallies (just an ugly dip) then you're still partially invested and have capital to buy the stronger stocks.

I understand that you can't make any changes without testing and I agree this is the correct course of action. I also know that discretionary ideas are also very hard to code. The ideas that I've suggested CAN be coded if you think they have potential to improve performance.

It's times like these that I wish I could show you with back testing results how valuable these ideas are. I've only got 15 years trading experience to know that they are.

@Skate 's stale exit is only one way a portfolio can be kept in the strongest momentum moves. Selling the weakest stocks first at the early signs of market bearishness is another way.

Rotational momentum systems always ensure the portfolio is filled with the strongest movers. They cull the slowest movers in the portfolio (even if price is going up).

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Then if the market goes further down exit all (GTFO exit).

@peter2 what a timely post. Momentum is critical to any strategy let alone the "Action Strategy". Momentum is one of the deciders when to enter a confirmed trend.

Stale Exit

A "stale Exit" is another kettle of fish as it measures the price differential bar-by-bar. Positions can have a strong run-up only to "bob around" in a confined price range. Whether the position is a winner or a loser plays no part in how the"Stale Exit" is calculated.

The GTFO Filter

Using this type of filter ensures your strategy is fully in or fully out of the strategy. The bad news is that today's massive move activated the "Action Strategy" GTFO filter. As a result, the "Action Strategy" has to be totally liquidated.

Liquidating a performing strategy

The GTFO Filter is designed to do a job & it's hard to stomach particularly when the strategy ends the week on a positive note.

Skate.

- Joined

- 27 August 2017

- Posts

- 1,450

- Reactions

- 749

I wasn't happy with how long it took for my Index Filter to turn back on after the flash crash. After testing my system before and after it I came to the decision not to use it that way and only to tighten my stops.

I don't think the next Bear Market will be sudden like the last but roll over first, although it is just MHO. But I also think the high will be taken out before a Major Bear Market starts too.

I don't think the next Bear Market will be sudden like the last but roll over first, although it is just MHO. But I also think the high will be taken out before a Major Bear Market starts too.

Week 31

Buy: None

Sell: 10 (trailing stop triggered by index filter)

Time for a proper update. All sells got a fill. some of them were slight losers, some were winners. My portfilio is left with mostly winning positions right now. Overall for week 31 I was up until Friday. I still beat the index but lost to the XAOA which remained unaffected (relatively) to the sudden move down last Friday.

Not every week can be a winner. I have had a pretty good run so far and as you can see by the graph below, heading upwards. While the index filter off is a shame, it's there to protect my portfolio. It may be the case that selling off those positions wasn't good, but it may be the case that a correction is coming. Hindsight will be 20-20. My musings before about the index filter are just some outloud thoughts. I have followed my system, even during the COVID crash. Doesn't mean that occasionally you wont have some small niggling doubts.

Buy: None

Sell: 10 (trailing stop triggered by index filter)

Time for a proper update. All sells got a fill. some of them were slight losers, some were winners. My portfilio is left with mostly winning positions right now. Overall for week 31 I was up until Friday. I still beat the index but lost to the XAOA which remained unaffected (relatively) to the sudden move down last Friday.

Not every week can be a winner. I have had a pretty good run so far and as you can see by the graph below, heading upwards. While the index filter off is a shame, it's there to protect my portfolio. It may be the case that selling off those positions wasn't good, but it may be the case that a correction is coming. Hindsight will be 20-20. My musings before about the index filter are just some outloud thoughts. I have followed my system, even during the COVID crash. Doesn't mean that occasionally you wont have some small niggling doubts.

Looks like this system trader is doubting his system. IMO an index filter is a real tricky thing to include in a momentum trading system. The main reason is deciding what parameters to use with the index. If the period is too small then one down week can turn it off. This gets us out of the market quickly but this may be premature and triggered by what turns out to be a normal dip in a bullish market. If the parameter is too long, then we lose too much of our open profit and we're late into the next bullish rally.

The system trades bullish momentum in individual stocks. Stocks most in demand start moving first and it's their movement that causes the index to move. Stocks make the index move, yet in our mom system we place the cart before the horse and wait for the index to move before trading individual stocks. It doesn't make sense (to me).

I was never comfortable with any parameter I chose for the index and that's why my index filter doesn't turn the trading system off/on. I use it as a warning indicator to reduce/increase portfolio heat. @rnr made a valuable comment that his index filter indicates which setups to use.

I've no doubt that your (@Warr87 ) portfolio holds many positions that are losing money. Why don't you sell all the biggest losers when the index filter triggers this action. Then if the market goes further down exit all (GTFO exit). If the market rallies (just an ugly dip) then you're still partially invested and have capital to buy the stronger stocks.

I understand that you can't make any changes without testing and I agree this is the correct course of action. I also know that discretionary ideas are also very hard to code. The ideas that I've suggested CAN be coded if you think they have potential to improve performance.

It's times like these that I wish I could show you with back testing results how valuable these ideas are. I've only got 15 years trading experience to know that they are.

@Skate 's stale exit is only one way a portfolio can be kept in the strongest momentum moves. Selling the weakest stocks first at the early signs of market bearishness is another way.

Rotational momentum systems always ensure the portfolio is filled with the strongest movers. They cull the slowest movers in the portfolio (even if price is going up).

Great info p2. you are right about the pitfalls of an index filter. the index has been moving only slightly so it has been skirting with that filter for a couple of weeks. One big push down finally crossed that line. Maybe the system has exited prematurely? Overall, I don't think my system suffers from whipasaw so I don't think this will happen here.

I am designing a new system for daily, and it doesn't even use an index filter. with the momentum type strategies I have been working on it does seem that an index filter in some cases can make things worse. no better performance or lower DD during crashed but slow to pick up new winners. as you say, for this system I can't really change it without testing. For the moment, it stays where it is. I don't know how long I will trade this system for, but for the moment it works I will continue.

I'm going to have to come back to this post the next time I design a system.

Week 32:

Buy: none (index down)

Sell: 2 hit 10% stoploss (from index down)

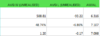

Not much to say about this week. Even though I have half the positions I still maintained my current proft, if not finished a little ahead. Nice to make the same amount but with half the amount invested. Definitely pulling away from the index as well.

TotalPL : -5.09

This week gain: 2.09%

Open positions: 10

Positions remaining: 10

Index down

Buy: none (index down)

Sell: 2 hit 10% stoploss (from index down)

Not much to say about this week. Even though I have half the positions I still maintained my current proft, if not finished a little ahead. Nice to make the same amount but with half the amount invested. Definitely pulling away from the index as well.

TotalPL : -5.09

This week gain: 2.09%

Open positions: 10

Positions remaining: 10

Index down

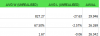

Week 33

Buy: none (index down)

Sell: 1 sell for stale exit.

Very flat week. Even though today ended down, I managed to still scrap through a little profit. Overall a good week. I'm continuing to break away from the index. I was surprised to see a stale exit but I have had that position for almost 19 weeks, so it probably is a good idea to sell and when the index picks up again, gain a new position. After this sale I will have 7 positions.

System at -2.61%, gain of 2.48% this week. 8 positions with 1 to be sold Monday.

Buy: none (index down)

Sell: 1 sell for stale exit.

Very flat week. Even though today ended down, I managed to still scrap through a little profit. Overall a good week. I'm continuing to break away from the index. I was surprised to see a stale exit but I have had that position for almost 19 weeks, so it probably is a good idea to sell and when the index picks up again, gain a new position. After this sale I will have 7 positions.

System at -2.61%, gain of 2.48% this week. 8 positions with 1 to be sold Monday.

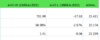

Week 34

Buy: None (index down)

Sell: none for positions I hold

I thought I was going to end the week slightly positive. Despite the market also being slightly up today I ended up very slightly down. Overall most days were good for me when I had a look. Overall, I lost 0.84% this week which is nothing. Not every week can be a winner . I'm still outpacing the indexes. Something catastrophic would have to happen to change that.

. I'm still outpacing the indexes. Something catastrophic would have to happen to change that.

I'm looking forward to the index turning back on as I have doubled my capital allocation to this system. (So its no longer a 'tiny' account but a 'small' account lol.) It's still small compared to others but in time .... Regardless even with the small capital I started with I have outpaced returns in some managed funds I had with twice the money.

Currently hold 7 positions

Index down (trailing stop at 10%)

system at -3%

This week: -0.84%

Buy: None (index down)

Sell: none for positions I hold

I thought I was going to end the week slightly positive. Despite the market also being slightly up today I ended up very slightly down. Overall most days were good for me when I had a look. Overall, I lost 0.84% this week which is nothing. Not every week can be a winner

I'm looking forward to the index turning back on as I have doubled my capital allocation to this system. (So its no longer a 'tiny' account but a 'small' account lol.) It's still small compared to others but in time .... Regardless even with the small capital I started with I have outpaced returns in some managed funds I had with twice the money.

Currently hold 7 positions

Index down (trailing stop at 10%)

system at -3%

This week: -0.84%

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

I was never comfortable with any parameter I chose for the index and that's why my index filter doesn't turn the trading system off/on. I use it as a warning indicator to reduce/increase portfolio heat. @rnr made a valuable comment that his index filter indicates which setups to use.

The problem I have with index filters is that most people default to using a broad index as their filter...that is, folks seem to default to using the XAO index as their filter. I've had much better success using sector indexes as filters: I'll check the sector index filter of a stock before deciding to take the trade. This approach still has some downsides but overall it performs much better than using the broad XAO index.

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

In my experience an index filter is only good for systems that have a longer term hold time. I also trade a short term swing system (average hold time 3 days) and any type of index filter is completely useless and really kills performance of the system.i've backtested using specific filters and got better results with the XAO as a filter. I guess it depends on your system. I agree that just using the XAO for the sake of using the XAO isn't the best approach.

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

Coincidently, Nick Radge just published this on twitter re index filters

www.thechartist.com.au

www.thechartist.com.au

Trade Management With An Index Filter

Now we're going to look at how that same short term trend filter can improve trade management. Before we jump in it's imperative to mention...

Week 35

Buy: none

Sell: 2 SL's triggered

I only had time to check early in the week, and things were going good. This obviously changed by the end of the week, particularly Friday which hit me the hardest lol.

I lost 3% this week. The XAO lost a fraction more. Yay for me I guess lol. The fact that I have my index filter on is helping. I have triggered 2 stoploss's for this week, both are in for a profit. One of them is my biggest winner. I only have 1 position that is losing right now so overall I am in good health. I know when the market starts going up again I will be a bit slow due to my filter, but the safety it is giving me is worth it in this system.

Buy: none

Sell: 2 SL's triggered

I only had time to check early in the week, and things were going good. This obviously changed by the end of the week, particularly Friday which hit me the hardest lol.

I lost 3% this week. The XAO lost a fraction more. Yay for me I guess lol. The fact that I have my index filter on is helping. I have triggered 2 stoploss's for this week, both are in for a profit. One of them is my biggest winner. I only have 1 position that is losing right now so overall I am in good health. I know when the market starts going up again I will be a bit slow due to my filter, but the safety it is giving me is worth it in this system.