The MAP strategy - Live

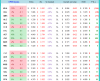

Week 1 - first scan run 31 Jan 20. First buys placed for 3 Feb 20

Buy: WJA, RUL, QMS, ALG, NEU, CCX, DTL, AEF

Week 2

Buy: AVZ, MAH, RMC, CL1, ADH, JLG, MSG, ORE, VRL, PAR, PPH

One of my positions wouldn't fill. I tried again and still had my open position closed. Trading was suspended so that position was never filled.

Week 3

Buy: APD

Sell: None

A number of buy signals for positions that I already hold. That is always something I like to see!

Week 1 - first scan run 31 Jan 20. First buys placed for 3 Feb 20

Buy: WJA, RUL, QMS, ALG, NEU, CCX, DTL, AEF

Week 2

Buy: AVZ, MAH, RMC, CL1, ADH, JLG, MSG, ORE, VRL, PAR, PPH

One of my positions wouldn't fill. I tried again and still had my open position closed. Trading was suspended so that position was never filled.

Week 3

Buy: APD

Sell: None

A number of buy signals for positions that I already hold. That is always something I like to see!