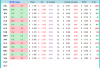

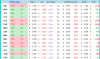

System 1 (EMA Cross Strat):

Week 20:

Buy: None

Sell: None

Like last week, nothing going on here.

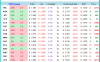

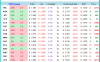

Open Positions: 15

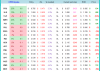

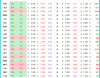

System 2 (MAP Strat):

Week 7:

Buy:KMD and MOE

Sell: FLC, DCG and AQZ

Open Positions: 18, 2 to be opened with 3 to be sold. Will have 17 positions as of Monday.

Notes: I am once again a little frustrated that my systems haven't made more. It is obviously early days and expected, but the annoyance and lack of patients is definitely there. The fact I am not in a drawdown should be good enough, especially since most systems will be down in the beginning, but obviously I want more success! (Who doesn't?) Will have to do a comparison soon on my performance vs. backtesting to the systems start date.

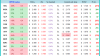

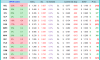

Week 20:

Buy: None

Sell: None

Like last week, nothing going on here.

Open Positions: 15

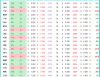

System 2 (MAP Strat):

Week 7:

Buy:KMD and MOE

Sell: FLC, DCG and AQZ

Open Positions: 18, 2 to be opened with 3 to be sold. Will have 17 positions as of Monday.

Notes: I am once again a little frustrated that my systems haven't made more. It is obviously early days and expected, but the annoyance and lack of patients is definitely there. The fact I am not in a drawdown should be good enough, especially since most systems will be down in the beginning, but obviously I want more success! (Who doesn't?) Will have to do a comparison soon on my performance vs. backtesting to the systems start date.