nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

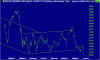

Westpac got hit hardest of all the banks and the interday low of $21.05 was the lowest it has been this year. If this is the start of the second "dip" I am in big trouble  If it is a correction with any hope of a rebound then I am not in trouble

If it is a correction with any hope of a rebound then I am not in trouble  .

.

I am giving it another 2 weeks to play out. If it is still in the red come 30 June I will close out the losses to offset capital gains (then probably go back in for any rebound).

I am giving it another 2 weeks to play out. If it is still in the red come 30 June I will close out the losses to offset capital gains (then probably go back in for any rebound).