- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

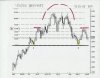

USD/CHF ....WOW! How come I didn't see that ?

USD/CHF ....WOW! How come I didn't see that ?

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective. This information is for educational purposes and should not be considered trading recommendations. All trading decisions are your own sole responsibility …

USD/CHF ....WOW! How come I didn't see that ?

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliott Waves which are highly subjective. This information is for educational purposes and should not be considered trading recommendations. All trading decisions are your own sole responsibility …