- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

It's funny how the rules change almost daily when the music stops. Talk about creative accounting. But, the market loved it, and the shares go up. The Lemmings still can't see that the emperor hasn't any clothes on!

So what is 'negative fair value'?

So what is 'negative fair value'?

Plot summary

An emperor who cares too much about clothes hires two swindlers who promise him the finest suit of clothes from the most beautiful cloth. This cloth, they tell him, is invisible to anyone who was either stupid or not fit for his position. The Emperor is nervous about not being able to see the cloth himself so he sends his ministers to view it. They see nothing yet praise the cloth. When the swindlers report a suit of clothes has been fashioned, the Emperor allows himself to be dressed in their creation for a procession through town. During the course of the procession, a small child cries out, "But he has nothing on!" The crowd realizes the child is telling the truth and begins laughing. The Emperor, however, holds his head high and continues the procession.

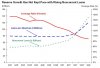

May 14 (Bloomberg) -- Freddie Mac, the second-largest U.S. mortgage-finance company, reported a smaller loss than analysts estimated after accounting changes reduced charges by at least $2.6 billion.

Without the use of two new accounting rules, Freddie Mac would have posted a loss of at least $1.7 billion, analysts said. A change in the way the company values some assets that aren't traded reduced credit losses by $1.3 billion, while a separate rule that lets the company pick and choose which assets to measure contributed an equal amount, Freddie Mac said.

...

Financial Accounting Standard 157 allows companies to estimate a value on holdings that aren't traded. Freddie Mac increased its Level 3 assets under FAS 157 to $156.7 billion, or 23 percent of its assets, from $31.9 billion as of December. The company also adopted FAS 159, which lets it pick which financial assets and liabilities to measure at fair value through earnings.

...

Chief Executive Officer Richard Syron said the new accounting better reflects ``the underlying performance of our business'' as the market continues to deteriorate.

Freddie also reported that the "fair value," or estimated market value, of its net assets was a negative $5.2 billion as of March 31, compared with a positive $12.6 billion three months earlier. That means the estimated market value of assets falls short of estimated liabilities, largely stemming from the costs of mortgage defaults. [Chief financial officer] Mr. Piszel said the negative fair value reflects current distressed prices for mortgage securities and has "no impact" on the operations of a company like Freddie that is a long-term holder of mortgages.