Good evening @frugal.rock

Hoping find you well. Yes indeed, there certainly has been more than a spark generated of late

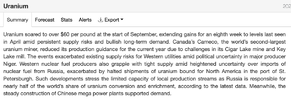

Great volume today exhibited by URNM, like to see that 6 figures. Would even be somewhat happy with around that 55 000 more regularly. Not holding.

Certainly, nice movement, great opening, then stabilisation and limited variance could well set the scene for Monday ?

Have a very nice weekend.

Kind regards

rcw1