- Joined

- 1 February 2006

- Posts

- 568

- Reactions

- 7

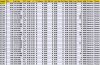

Refresh my memory - why are there some odd trades waiting in the market, for example 1 share in OZL @ 1.30 this morning, well below the market?

As far as I am aware, this doesnt mean that a sale will go through at 1.30. So what is this trade supposed to be achieving?

As far as I am aware, this doesnt mean that a sale will go through at 1.30. So what is this trade supposed to be achieving?