So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,469

- Reactions

- 1,475

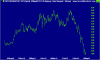

$1000 worth of TRY with a Limit of $1.95 a share. Personally I think it's already a bargain and am happy to wait out any short term volatility for a good company.

A limit buy above the close of 1.87 ok so some times its nice to be first in the cue... hasn't worked out to well for me over the last 6 years, im a 'let the price come to me' kinda guy...1000 bucks hey, the brokerage is gona be a killer. 1.5 > 2% down straight up.

Good luck.