Hi guys,

Thought I'd post some of my trades and analysis as much as possible in real time. This is how I have been trading for almost 7 years now and I cant complain too much. I take tons of losses but my gains are greater.

The main reason I am posting these is because I am more than happy for feedback/suggestion/criticisms etc on volume and price trading, my trade management or risk management. Anything that can make me better and is useful to my trading I am grateful for.

I'll start with 2 trades I am in. One is more recent than the other.

High level approach. I follow daily market structure and wait for a pullback. When price closes over the downward DAILY trend line I switch to 1 or 4h view and wait for price to close above significant transactions. This signifies to me that the probability of the path of least resistance being upward is more likely than not. I enter on the 1 or 4h and target the daily high or daily measured move.

Thanks in advance

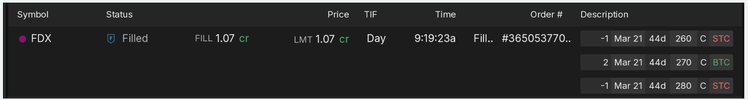

This trade executed yesterday.

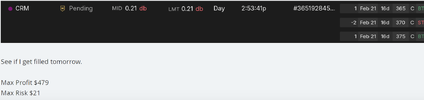

This trade was taken a few days ago.

Thought I'd post some of my trades and analysis as much as possible in real time. This is how I have been trading for almost 7 years now and I cant complain too much. I take tons of losses but my gains are greater.

The main reason I am posting these is because I am more than happy for feedback/suggestion/criticisms etc on volume and price trading, my trade management or risk management. Anything that can make me better and is useful to my trading I am grateful for.

I'll start with 2 trades I am in. One is more recent than the other.

High level approach. I follow daily market structure and wait for a pullback. When price closes over the downward DAILY trend line I switch to 1 or 4h view and wait for price to close above significant transactions. This signifies to me that the probability of the path of least resistance being upward is more likely than not. I enter on the 1 or 4h and target the daily high or daily measured move.

Thanks in advance

This trade executed yesterday.

This trade was taken a few days ago.