Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 204

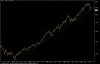

Mine has turned into a quick scalp- I'm out already. I'm not liking the action in the rest of Asia- nikkei has put in a double top, and HK has moved down to new lows after the opening gap.

Yeah watch out for the 2:00 to 2:30 margin call time. A lot of the specie and mid cap stuff have just turned into Junk.

I'm with you I'm Out but looking to get back in. Not a bad trade but just not the push I was looking for from the Bulls. Time to get some food and get ready for the mess at 2:00