- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

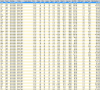

To deal with survivorship bias, why don't u run a backtest on say S&P100 constituents from late 2000 - see attached.

View attachment 54839

Have S&P 500 constituents too back to 1990.

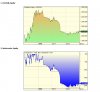

^^ This is the obvious solution. Doing this will put an end to the arguments and show us how significant survivorship bias is. Overlay the first equity curve with the survivorship-free equity curve, so we can get a quick visual.