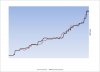

While we are posting our equity curve pr0n, here is mine on the HSI for the 6 days I've been back at it this year. Including commish cost (Note shabby start see Blog for excuses)

Just breaking even would have been extremely impressive to me. Can't imagine the kind of skill required to overcome the spread and commissions on such shorterm trading, let alone doing it 100 times a day.