tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

"Drink till it's gone"

Post number 2

From another quality poster

With nothing to add to the

Community

"Drink till it's gone"

Some software will draw swing charts for you. I have found that no individual indicator is a reliable stand alone and swing charts are no different.

Here is a small selection of links from a quick google search of "swing charts":

http://www.investopedia.com/articles/technical/04/080404.asp

http://stockcharts.com/school/doku.php?id=chart_school:trading_strategies:swing_charting

http://www.stock-trading-infocentre.com/swing-charts.html

Sails

They can't be used as a trading tool.

For the Same reason you can't use fib function in a trading systems test.

The last swing can't be confirmed until it has corrected the % chosen.

Let's take a 10 % swing

You see a pivot and take the trade stop a few ticks above the

Pivot.

It drops 8 % swings back and adds 15 %

the original pivot disappears and just appears

As a high in a continuing trend.

This happens often-----before a swing pivot can be set in cement

By completing it's % swing.

Same happens with Kagi,Renko point and figure etc.

Sails

They can't be used as a trading tool.

For the Same reason you can't use fib function in a trading systems test.

The last swing can't be confirmed until it has corrected the % chosen.

Let's take a 10 % swing

You see a pivot and take the trade stop a few ticks above the

Pivot.

It drops 8 % swings back and adds 15 %

the original pivot disappears and just appears

As a high in a continuing trend.

This happens often-----before a swing pivot can be set in cement

By completing it's % swing.

Same happens with Kagi,Renko point and figure etc.

Hi Tech, I agree they can't be tested in a trading systems test. I use them but probably not in the conventional way. They are only a very minor part of analysis and definitely not used in isolation.

I'm not recommending them - I simply provided some links I found with a 10 second google search in answer to a very broad question...

Sails

They can't be used as a trading tool.

For the Same reason you can't use fib function in a trading systems test.

The last swing can't be confirmed until it has corrected the % chosen.

.

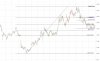

Not the type of swing charts I use. I use Gann's way of drawing them, and they are based on highs and lows, not percentages, can be back tested and can be traded on their own profitably. I use MAV and ATR with them as a filter, but I know some very profitable traders that just use swing charts and ranges. They are a great way to remove the noise from the bar chart.

Can you give us some examples, either ones that come up in backtests or live discretionary?

+ 1

When is a high a high.

When is it set in concrete.

The day it happens

A week after it happens?

You have EXACTLY the same problem.

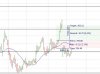

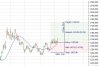

You can set up your analysis so for a high to be a valid high it needs to be the highest high n bars before and n bars after it appeared – so n bars after it appeared and its still the highest high over the past 2n bars, it’s a valid pivot that will never disappear - for the given 'n' level analysis.

Yes you can

But many will disappear after n bars.

Trade it----

Code it and test it.

The " n " becomes the old % swing.

Which " n " do you choose to confirm the high and take the trade.

Too early too many stops

Too late trade is over.

None will disappear after n bars, the rear view n bars after a valid peak has been identified never changes.

I have coded it, and tested it - and yes I learnt the hard way until I adopted this approach.

n is an arbitrary number of your choosing. If you make it 1 you can build a pivot map of the entire chart which opens up a raft of pattern exploration options.

Not that any of them seem to work particularly well, programmatically anyway, but that's another story.

Again the example is shown in hind site.

If your so sure this works as perfectly as hind site

Put up 5 trades.AS IT HAPPENS WITH COMMENTARY.

I'll put up the usual $500 to Joe if you get 3 out of five

To play out as your forward commentary.

Be specific.

2 or less I would hope you'd support your local ASF.

Of course it was an explanation after the event, sadly I cant show broker statements for trades I dont take.

If you think that this doesnt work thats ok, no one is forcing you to change the way you trade. So just leave the thread for those that do believe in it to share ideas, and for those that want to learn. If you want to argue, start a thread on politics or religion.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.