Oil Trade

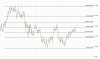

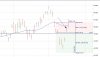

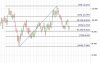

The 50% Fib level has finally been broken, so now stop moved to just under that level at $98.87 which is also just past the price at where a swing down would be confirmed, and just under the swing top around 11th Dec. So 3 reasons to put it there.

View attachment 56028

The 50% Fib level has finally been broken, so now stop moved to just under that level at $98.87 which is also just past the price at where a swing down would be confirmed, and just under the swing top around 11th Dec. So 3 reasons to put it there.

View attachment 56028