Dona Ferentes

beware the aedes of marsh

- Joined

- 11 January 2016

- Posts

- 16,826

- Reactions

- 22,979

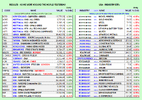

Australia's third largest lender by market value Westpac $WBC reported net profit attributable of $6.99 billion for the year ended September 30, compared with $7.20 billion reported last year and an LSEG estimate of $6.50 billion. #ausecon #auspol

Quote

View attachment 187297

CommSec

@commsec

·

1m

Westpac Banking Corp $WBC reported a 3% fall in annual profit on Monday, due to rising costs and intense competition in the mortgage market, while it increased its buyback program by an additional $1 billion. #ausecon #auspol

wrong thread too much clutter .. put in Westpac