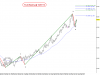

The price action on TLS has tested and fallen through the lower end of the upward sloping trend channel and is headed for a test of support at $4.50. I would await confirmation that this support line holds to see if this is indeed a healthy pullback or something a little more sinister. The key risk is continued weakness in the Australian dollar which will add further incentive for offshore investors to keep pulling money out of the Australian market - and they are primarily invested in the liquid, large cap stocks like TLS.