You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

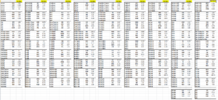

Tipping Competition for Full CY 2022

- Thread starter Joe Blow

- Start date

-

- Tags

- 2022 stock competition

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,452

- Reactions

- 6,504

Contests like this favour the fundamental analysts who are lucky enough to pick a low value stock with promise who do kick a goal and their price rockets. As a chartist I’ve got a bit of a handicap in that charting won’t predict long term goal kickers – it’s more accurate in seeing short/medium term potential. So no hope of winning (maybe the wooden spoon) but in the interest of supporting the forum here’s my ‘pin the tail on the donkey' selections.

I scanned the ASX300 for stocks coming off a significant low and have a chart that suggests they might come back from the dead. I found 13 but the following seemed to offer the most promise.

PDN Lower value stock – so more chance to move up

RRL Coming of a large price channel low – something it has moved up strongly from previously

SPL At a low and should go higher – especially if its products under development get traction

WEB Could be a winner once COVID morphs into just another common cold and people stop worrying about travel (a lot of pent up demand.

Hmmm I don’t know about that

As a fellow Chartist 80% wasn’t bad this year

Last the year before was lack of time

having developed techtrader which did very well over 7 years of live trading and with Pete 2 more technical than Fundamental I think we do and will do fine

The disadvantage of course is that when the trades we pick go south we would be out well before 12 mths but we are exposed for the full 12 mths

Fundamental traders have the same issue them —- may —— have exited well before the 12 mths

Pete is it possible to show if the entry is Tecnical or Fundamentally based Mine are technical.

Dona Ferentes

beware the aedes of marsh

- Joined

- 11 January 2016

- Posts

- 16,814

- Reactions

- 22,958

It's not binary, I don't reckon. And other factors at play, as well.Hmmm I don’t know about that

Is it possible to show if the entry is Technical or Fundamental?

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,452

- Reactions

- 6,504

Yes agree but thought there maybe some interest as it’s constantly debatedIt's not binary, I don't reckon. And other factors at play, as well.

- Joined

- 3 May 2019

- Posts

- 6,351

- Reactions

- 10,045

AXE top pick

CE1

MGV

NCZ

CE1

MGV

NCZ

Faramir

Very New Investor

- Joined

- 24 March 2014

- Posts

- 682

- Reactions

- 761

I had a very busy two weeks and I thought that I would miss out on this yearly comp. I had absolutely no idea which stocks to pick. So I let The Bull (thebull.com.au) decide for me ? If I am right (should I say if they are right), then these stocks are in a Bull phrase. If I am wrong - then my picks are completely Bull #$$*

LCK

MM8

PLY

SHG

If I had to pick the best one? Maybe LCK because it’s first off my list alphabetically and closest to 10 cents.

LCK

MM8

PLY

SHG

If I had to pick the best one? Maybe LCK because it’s first off my list alphabetically and closest to 10 cents.

- Joined

- 2 May 2007

- Posts

- 4,745

- Reactions

- 3,003

Hi @Joe Blow Monday 3 January ASX and banks are closed in Australia, so may be you extend one day more for closingDeadline is midnight on Sunday, 2 January 2022.

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,504

- Reactions

- 4,626

I almost forgot about this competition this year. I hope I'm not too late. These are my picks:

A1M - Great management, copper producer, awesome exploration projects

HIO - Great Iron ore project

KWR - Lots of potential here

RRR - Massive sulphides = yes, yes, yes.

Just a random selection of stocks I think will do well in 2022. I will post in their threads in the next couple of days.

A1M - Great management, copper producer, awesome exploration projects

HIO - Great Iron ore project

KWR - Lots of potential here

RRR - Massive sulphides = yes, yes, yes.

Just a random selection of stocks I think will do well in 2022. I will post in their threads in the next couple of days.

- Joined

- 2 May 2007

- Posts

- 4,745

- Reactions

- 3,003

@Sean K and @finickyI would pick all these too. But I think I'll pip you, just because my picks are unloved turds that can't go too much lower.

Interesting Pip

As @Joe Blow has not specified the tie in rule so I am assuming if both of you win, then Joe has to award two first prizes.

If he asks you to share, which means the second prize holder will take more money than the first prize holder

PZ99

( ͡° ͜ʖ ͡°)

- Joined

- 13 May 2015

- Posts

- 3,331

- Reactions

- 2,448

Usually if there's a tie for 1st the next runner would be 3rd.

So both winners would get $750 each and 3rd gets the $350

So both winners would get $750 each and 3rd gets the $350

- Joined

- 19 August 2021

- Posts

- 249

- Reactions

- 736

Agreed that T/A should do OK - just not as well as F/A I suspect. And obviously someone who pursues both disciplines would have an even greater advantage. I'd be interested in the stats as well but I wonder how many choices are stocks that you would go out and put your money on today and how many have an element of a 'bit of a punt' in the hope of a big percentage gain.Hmmm I don’t know about that

As a fellow Chartist 80% wasn’t bad this year

Last the year before was lack of time

having developed techtrader which did very well over 7 years of live trading and with Pete 2 more technical than Fundamental I think we do and will do fine

The disadvantage of course is that when the trades we pick go south we would be out well before 12 mths but we are exposed for the full 12 mths

Fundamental traders have the same issue them —- may —— have exited well before the 12 mths

Pete is it possible to show if the entry is Tecnical or Fundamentally based Mine are technical.

- Joined

- 25 July 2016

- Posts

- 334

- Reactions

- 675

Hey Peter,

Can I change SYR to TIE?

Cheers

Can I change SYR to TIE?

Cheers

- Joined

- 28 May 2004

- Posts

- 10,904

- Reactions

- 5,426

Hi @Joe Blow Monday 3 January ASX and banks are closed in Australia, so may be you extend one day more for closing

I forgot today was a public holiday, so I don't mind extending the deadline until midnight tonight. I can't remember when we had so many public holidays. Six public holidays in the last couple of weeks. Anyway, it is a nice surprise that today is a public holiday. I'm going to have an unexpected slow day and do some weeding and put something in the slow cooker.

- Joined

- 20 July 2021

- Posts

- 12,074

- Reactions

- 16,802

enjoy !I forgot today was a public holiday, so I don't mind extending the deadline until midnight tonight. I can't remember when we had so many public holidays. Six public holidays in the last couple of weeks. Anyway, it is a nice surprise that today is a public holiday. I'm going to have an unexpected slow day and do some weeding and put something in the slow cooker.

brerwallabi

The Oracle

- Joined

- 5 July 2004

- Posts

- 1,053

- Reactions

- 817

All my picks for the year I actually own.Agreed that T/A should do OK - just not as well as F/A I suspect. And obviously someone who pursues both disciplines would have an even greater advantage. I'd be interested in the stats as well but I wonder how many choices are stocks that you would go out and put your money on today and how many have an element of a 'bit of a punt' in the hope of a big percentage gain.

The picks were XF1, NIC, AIS and PAN all four met my criteria from a fundamental point of view.

With the exception of AIS, from a chart perspective all were trending up and from an objective Elliot Wave point of view may have a long way to go.

AIS I have quite a small holding 7500 shares, again from an Elliot Wave point of view it met criteria after a 5 up and 3 down and showing a possible cup and handle over a three year period. The last couple of months it seems to be ranging between 15 to 17 cents on considerably lower volume my thinking is it breaks upwards.

- Joined

- 20 July 2021

- Posts

- 12,074

- Reactions

- 16,802

i don't hold PWR ( yet ) i didn't hold ABE when i posted the entry , but do , now and hold the other two ( EVN and SIG for several years )All my picks for the year I actually own.

The picks were XF1, NIC, AIS and PAN all four met my criteria from a fundamental point of view.

With the exception of AIS, from a chart perspective all were trending up and from an objective Elliot Wave point of view may have a long way to go.

AIS I have quite a small holding 7500 shares, again from an Elliot Wave point of view it met criteria after a 5 up and 3 down and showing a possible cup and handle over a three year period. The last couple of months it seems to be ranging between 15 to 17 cents on considerably lower volume my thinking is it breaks upwards.

i also hold AIS and am looking to buy more if it dips noticeably below 15c ( where i bought in )

good luck

the Chinese New Year normally takes away gold/copper price support for a a couple of months , but i see a falling US dollar ( compared to most commodities ) but rising costs might be the confounding factor

- Joined

- 12 January 2008

- Posts

- 7,407

- Reactions

- 18,524

84 competitors so far.

There's got to be approx 20 who participated last year who have not submitted any selections this year.

There's got to be approx 20 who participated last year who have not submitted any selections this year.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,452

- Reactions

- 6,504

Natural attrition

May not be on site any longer

May not be on site any longer

- Joined

- 12 January 2008

- Posts

- 7,407

- Reactions

- 18,524

Similar threads

- Replies

- 241

- Views

- 17K

- Replies

- 38

- Views

- 2K

- Replies

- 44

- Views

- 3K

- Replies

- 63

- Views

- 5K

- Replies

- 5

- Views

- 587