TechnoCap

Life is one hell of a ride

- Joined

- 14 February 2021

- Posts

- 152

- Reactions

- 99

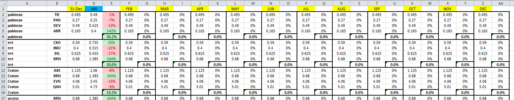

1. SOR

2. AXE

3. DEV

4. LOT

currently holding these nominated stocks

2. AXE

3. DEV

4. LOT

currently holding these nominated stocks

Last edited: