- Joined

- 12 January 2008

- Posts

- 7,402

- Reactions

- 18,506

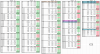

Trial run of some excel macros that pixel kindly provided.

A one button entry gets all the prices for the 148 stock codes while I'm having a beer. Thank you pixel.

The macro automatically gets the prices from a Yahoo financial webpage and a lookup function updates my spreadsheet. All I have to do is arrange the order and cut/paste the table into the final format that I post here.

As this is a yearly comp I think a monthly update is sufficient.

A one button entry gets all the prices for the 148 stock codes while I'm having a beer. Thank you pixel.

The macro automatically gets the prices from a Yahoo financial webpage and a lookup function updates my spreadsheet. All I have to do is arrange the order and cut/paste the table into the final format that I post here.

As this is a yearly comp I think a monthly update is sufficient.