- Joined

- 14 December 2005

- Posts

- 937

- Reactions

- 1

no problem tech/a

You quoted an extract from my earlier post and so your question was directed to me at least as well as anyone else you had in mind.

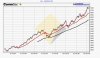

I also specifically mentioned the weekly XJO chart in my post you quoted from and since you did not mention the DJI or any other index at all in your reply there is simply no reason why anyone should not think you included the XJO in your comments.

My original post wasn't even directed to you personally. It was directed to all who read this thread.

If you want to be taken seriously then maybe consider being more specific in your posts and say what you mean and mean what you say.

see you in the swamp

bullmarket

You quoted an extract from my earlier post and so your question was directed to me at least as well as anyone else you had in mind.

I also specifically mentioned the weekly XJO chart in my post you quoted from and since you did not mention the DJI or any other index at all in your reply there is simply no reason why anyone should not think you included the XJO in your comments.

My original post wasn't even directed to you personally. It was directed to all who read this thread.

If you want to be taken seriously then maybe consider being more specific in your posts and say what you mean and mean what you say.

see you in the swamp

bullmarket