Hi All,

I'm raising this issue to see what peoples thoughts are. I personally currently see China as the next most likely country to have a serious crash. Whilst other countries do look arguably crook in their own ways, do to specific things (US monetary and fiscal policy, for instance), as far as I see it China has the strongest indications of the 'unsustainable boom followed by crash' scenario playing out.

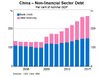

As the US did prior to 2008, China is currently sustaining negative real interest rates. They are also busy piling resources and credit into building things that are not getting used (yes this includes the empty cities). This smacks of a artificial credit-induced boom. Then you have the fact that the Chinese government is still far from full-capitalist, leaving plenty of room for socialistic market distortions (a recent example was the reactions from officials regarding food inflation, along the lines of 'banning hoarding', 'price controls' etc).

Now my reason for raising this thread is as follows. Given that China will have a substantial correction of some form, when there are finally enough empty buildings that the construction boom crashes to a halt - how do we gauge when it will occur, or how close it is to occurring? I think it is reasonable to say that many people would wish to be out of their shares prior to this occurring, ready to buy in when the ASX has fully collapsed.

So what are peoples thoughts on checking China for indications of an approaching crash? It could happen 1 year from now, 5 years from now, so one can't really leave the market entirely until it happens.

I'm raising this issue to see what peoples thoughts are. I personally currently see China as the next most likely country to have a serious crash. Whilst other countries do look arguably crook in their own ways, do to specific things (US monetary and fiscal policy, for instance), as far as I see it China has the strongest indications of the 'unsustainable boom followed by crash' scenario playing out.

As the US did prior to 2008, China is currently sustaining negative real interest rates. They are also busy piling resources and credit into building things that are not getting used (yes this includes the empty cities). This smacks of a artificial credit-induced boom. Then you have the fact that the Chinese government is still far from full-capitalist, leaving plenty of room for socialistic market distortions (a recent example was the reactions from officials regarding food inflation, along the lines of 'banning hoarding', 'price controls' etc).

Now my reason for raising this thread is as follows. Given that China will have a substantial correction of some form, when there are finally enough empty buildings that the construction boom crashes to a halt - how do we gauge when it will occur, or how close it is to occurring? I think it is reasonable to say that many people would wish to be out of their shares prior to this occurring, ready to buy in when the ASX has fully collapsed.

So what are peoples thoughts on checking China for indications of an approaching crash? It could happen 1 year from now, 5 years from now, so one can't really leave the market entirely until it happens.