- Joined

- 28 March 2006

- Posts

- 3,576

- Reactions

- 1,339

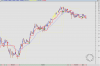

On that note, has anyone got any additional input from a TA perspective into TGA? Would be greatly appreciated.

Weekly charts are more useful on slow moving/low volume stocks such as TGA.

(Trade the smaller time frame but don't fight the bigger picture)

Any worthwhile upside seems to have ended about a year ago Klogg.

It would have to start breaking back up through around 1.90 before it would make a shortlist imo.

Just my

(click to expand)