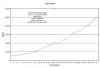

ok here is another attempt at getting my system off the ground. The testing universe is ASX200. It was developed on the Nasdaq 100. ( as howard bandy mentioned) . I have pasted the backtest reports from Tradesim and Amibroker. Time Period was 1 year.

Please feel free to comment, good and bad all welcome

Hi ROn1n,

If the results were from out of sample testing, you've got yourself a very decent system. The CARs are very good and the drawdowns more than acceptable. Also the number of trade opportunities available to you over the one year period is more than useful. You mentioned the test period of 1 year, which specific period is that ?

I am also assuming that both the Tradesim reports and Amibroker results were from testing the same system over the same period. The thing that surprises me somewhat is that teh Amibroker report - which would only be for a single run has produced results that exceeded the best results from 20,000 simulated runs using Tradesim. Possible off course, but highly unlikely, I would have thought.