Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,238

- Reactions

- 8,487

Isn’t that screen shot just saying they want to point out to people ways that they can access their capital to increase their quality of life in aged care, eg maybe getting extra services as Macca said wine with dinner, or maybe extra care.I am not upset at all. By all means pay for services you want.

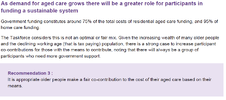

However, the intention of taskforces report isn't that. It's suggesting wealthier people pay more whether or not they access additional services. It's subtly worded as is the usual with these reports.

Oh well, I do hope the generations which follow understand they to will have to "make contributions for services to enjoy a dignified experience in aged care." After all the oldest Gen X will be 60 next year and in not that short a time (10 years or so), they also will require care. Maybe they'll get some of what's left of Mum and Dad's wealth to help them fund it.

Maybe deferred annuity products can be offered by superannuation funds to assist with aged care residency costs.

Page 40 of the report.

View attachment 173070