- Joined

- 8 June 2008

- Posts

- 13,128

- Reactions

- 19,311

So will the ATO reimburse the fund on unrealised capital losses in crash years?

I've been trying to get my head around the application of the additional 15% tax to unrealised capital gains and whether this is double taxation of capital gains. The conclusion I've reached is that it isn't really.

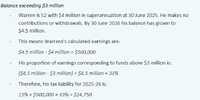

Say you have $3.1m in super and the $0.1m is used to buy shares. In 2 years time the shares have doubled in value, but the rest of your super hasn't changed in value. Under the new proposal, you will pay 15% tax on the unrealised capital gain of the shares, ie $15k over the two years.

If you now sell the shares you will pay 10% capital gain on the shares, ie $10k.

So under current rules you would be paying $10k tax on the profit from the shares. Under the new rules you would be paying $10k + $15k.

This is an extra 15% on income from balances > $3m, so it is exactly as the proposal intends. It is not double cg taxation plus an additional 15%.

It is nebulous. Thing is the press release (link below) is that the tax is proposed to be calculated based on Total Superannuation Balances over $3m and earnings are calculated as the difference between the TSB with adjustments for contributions/withdraws. That is what is concerning to some.

Think of it in this context. You hold a share at the end of 2025 and it is priced at a total of $3.5m (corrected to $3m). The next FY its value has increased by 50% to $4.5m. It hasn't been sold, you've just sat on it for the year and you don't meet a condition of release. The difference in TSB is $1.5m and the proposed tax arrangements, as it stands, is tax will be levied on that difference.

By the way, a number of major industry funds support a cap. Simple reason is it is very unlikely many, if any, of their members will be impacted. The really big money is in SMSFs.

The ATO has released data on SMSFs and APRA released data on funds with more than six members, i.e. non-SMSF. Real nerds can knock themselves out salivating over this stuff.

Self-managed super funds: A statistical overview 2020-21

Our self-managed super fund (SMSF) analysis and statistics annual overview for 2020–21 includes key data on the sector.www.ato.gov.au

Annual fund-level superannuation statistics | APRA

APRA publishes statistics on individual superannuation funds and their trustees, on an annual basis. These statistics contains information on fund profile and structure, financial performance and position, conditions of release, fees and membership. In October 2024 APRA released, for the first...www.apra.gov.au

the presser is referring to the tax being based on the TSB.

Yep, that's the crux of the matter.and is not going to let those really big funds off the hook.

Members of any SMSF worth just a few $ Mill are going to get it in the neck.

put in a claim !!So will the ATO reimburse the fund on unrealised capital losses in crash years?

So will the ATO reimburse the fund on unrealised capital losses in crash years?

According to the Treasury note - kind of.So will the ATO reimburse the fund on unrealised capital losses in crash years?

assuming you live that long ( i reckon we are heading into a deep recession , 'sunshine might be a decade away )According to the Treasury note - kind of.

They don't intend to reimburse tax paid, but unrealised capital losses can be used to offset future unrealised capital gains.

According to the Guardian, war with China is three years away and we dont even have guns, let alone finding an ammo shop. LOLassuming you live that long ( i reckon we are heading into a deep recession , 'sunshine might be a decade away )

And it it takes 20 y to break even, obviously you get screwed and die....According to the Treasury note - kind of.

They don't intend to reimburse tax paid, but unrealised capital losses can be used to offset future unrealised capital gains.

Maybe this will be true some people who hold assets in super that will generate high unrealised capital gains and have limited income outside of super.As I have said previously, I feel it isn't worth the pain to have more than the balance cap in superannuation but if you do it may be better to make sure it doesn't get close to the $3m which, for the purposes of this proposed taxation arrangements, will include adding back any withdrawals during the year. $2.5m max seems safer to me.

i am more concerned 'unrealized capital gains ( tax ) will be applied to other assets outside your super , sooner rather than later ( and that $3 million limit might shrink as well ) plenty of precedents to support that concernMaybe this will be true some people who hold assets in super that will generate high unrealised capital gains and have limited income outside of super.

However, many with high super balances will be generating income inside super and have income outside of super that takes them into the top tax bracket.

Surely they are still better off keeping income producing assets inside super and paying up to 30% tax if the balance exceeds $3m, rather than move them outside super and pay 45% tax + medicare levy?

Try to see the return on real estate, or even US shares etc.Maybe this will be true some people who hold assets in super that will generate high unrealised capital gains and have limited income outside of super.

However, many with high super balances will be generating income inside super and have income outside of super that takes them into the top tax bracket.

Surely they are still better off keeping income producing assets inside super and paying up to 30% tax if the balance exceeds $3m, rather than move them outside super and pay 45% tax + medicare levy?

Nailed it, how many middle income earners are going to own their house and nudge the $3m cap.Try to see the return on real estate, or even US shares etc.

I wish I could have issues with top tax rates with my current returns on the market, in or out of super and have no regret having always put minimum in super.

And as mentioned, don't have all your eggs in the same basket, otherwise the ducks, all in a row, get taken out.

Oh really, perhaps that will be changed in due course.According to the Treasury note - kind of.

They don't intend to reimburse tax paid, but unrealised capital losses can be used to offset future unrealised capital gains.

Pipe dream for most of the peasants that $3milNailed it, how many middle income earners are going to own their house and nudge the $3m cap.

Only those who inherit mum and dads Sydney/Melbourne home. LOL

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.