Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

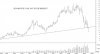

Re: SUN - Suncorp-Metway

Did any of you holders consider getting out when it rallied to $16 ish and waiting until there is some sort of definite uptrend again?

Seems pretty risky to be hanging in there in the hope of SUN becoming a takeover target.

Did any of you holders consider getting out when it rallied to $16 ish and waiting until there is some sort of definite uptrend again?

Seems pretty risky to be hanging in there in the hope of SUN becoming a takeover target.