SUN - Suncorp Group

- Thread starter mmmmining

- Start date

-

- Tags

- sun suncorp group

Re: SUN - Suncorp-Metway

Who do you see as a potential predator as far as SUN is concerned?

There seems to be a fair bit of consensus around the view that the authorities are concerned about the concentration of business in the hands of the big four banks; that the takeovers of BankWest and St George were only approved because of concerns about the GFC - and are now regretted; that further moves, at least on the regional banks by the big boys are unlikely to be approved.

That leaves the regionals. BOQ? Bendigo?

Anyone else?

Who do you see as a potential predator as far as SUN is concerned?

There seems to be a fair bit of consensus around the view that the authorities are concerned about the concentration of business in the hands of the big four banks; that the takeovers of BankWest and St George were only approved because of concerns about the GFC - and are now regretted; that further moves, at least on the regional banks by the big boys are unlikely to be approved.

That leaves the regionals. BOQ? Bendigo?

Anyone else?

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

Re: SUN - Suncorp-Metway

Its somewhat possible to follow my development as a share market punter in this thread...its clear from my early posts that i really didn't have a clue, i had confidence but clearly not a clue as to what was happening with regards to sentiment at the time.

Anyway my average buy in price for sun is $9.80 so i have recently been in profit with it and at these price levels am close to break even...however ill wait for the SP to break above $12 before doing any selling as i want to keep the bulk of my cheap shares.

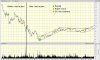

Still lots to like about the insurance business in general, and some upside potential for the Dividend going forward i would think....3 year chart of all my SUN activity below.

~

(1st-March-2008) Lets face it...anyone buying at the moment is bottom picking...(trying to pick the bottom)

I brought into SUN at 14.45 *28/02/08* so clearly missed the current bottom of 13.90.

Time will tell what's the real bottom...im still happy with a buy under 14.50

med/long term im sure ill do ok....still a little pissed off i didn't wait 1 day longer.:aufreg:

(8th-May-2008) I got in about the same time u did Andy...so todays high, about 10 weeks after buying in was good to see...for the first time with SUN, im in the money.

Value is Value.

Have to admit im pretty tempted to take the money and run....all this

negative sentiment has finally got to me.:dunno:

(1st-August-2008) More than happy to hold....today's ann was somewhat expected by the market, and subsequent

price action was pretty much a confirmation of the support at around $11...today's lows were about the same as we saw 4 months ago.

We have seen the worst for SUN and it wasn't that bad....for those of us that got in cheaply in the last 5 months or so.

(5th-Feb-2009) Timings all important...i was lucky i didn't get my modest average down order filled this week, SP would almost certainly fall below the 4.50 new issue price when trading resumes.

On the positive side of things...SUN will be well funded and still profitable and still with good prospects going forward, the doom and gloom wont last forever...however its gona be a long time till i see a profit with SUN.

Long long time....in for the long haul.

Lucky my Gold stocks are going off and sort of balancing out my portfolio.

(23rd-April-2009) The 3 month chart looks much better than the 3 year one...and that goes for all the financial's not just SUN....glass half full factors going forward.

Currently SUN is trading about 34% above the 52-wk Low ($4.42) and around 33% above the capitol raising issue price of $4.50...if the Dividend holds at 40c annually that would represent a return on the current SP ($6) of about 6.7% plus the franking benefits.......All looks ok to me.

(6th-August-2009) One thing for certain i got wrong over the last 9 months, is not buying anywhere near the amount of shares i really should of been buying....i think i brought like 700 bucks worth of SUN at like 4.70silly really.

What was i thinking :dunno: the doom and gloom was so heavy back then.

(6th-August-2009) As i posted before...i really didn't average down enough, but thank (whatever) that i did average down in all my key stocks, as im now in profit in most and close to break even in the others...my SUN break even is about $9...SUN was my worst entry and biggest % looser.

Its somewhat possible to follow my development as a share market punter in this thread...its clear from my early posts that i really didn't have a clue, i had confidence but clearly not a clue as to what was happening with regards to sentiment at the time.

Anyway my average buy in price for sun is $9.80 so i have recently been in profit with it and at these price levels am close to break even...however ill wait for the SP to break above $12 before doing any selling as i want to keep the bulk of my cheap shares.

Still lots to like about the insurance business in general, and some upside potential for the Dividend going forward i would think....3 year chart of all my SUN activity below.

~

Attachments

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

Re: SUN - Suncorp-Metway

Suncorp-Metway Limited is now Suncorp Group Limited. Lots off ASX releases on the 24th of December. When I logged in to Commsec I noticed my overall position was unexpected until I noticed the SUN price of 0.00. Next trading day or so I expect things to fix up. It will be using the same ASX code.

http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode&asxCode=SUN

Suncorp-Metway Limited is now Suncorp Group Limited. Lots off ASX releases on the 24th of December. When I logged in to Commsec I noticed my overall position was unexpected until I noticed the SUN price of 0.00. Next trading day or so I expect things to fix up. It will be using the same ASX code.

http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode&asxCode=SUN

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,028

- Reactions

- 11,124

Re: SUN - Suncorp-Metway

I have had a consistent line on SUN, varied since we went decimal, buy between 4 and 8, sell at 16.

Mugs in the pot between 8 and 16.

gg

I have had a consistent line on SUN, varied since we went decimal, buy between 4 and 8, sell at 16.

Mugs in the pot between 8 and 16.

gg

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

Re: SUN - Suncorp-Metway

In very late today at $8.17 i figured the biggest SP falls happen on the day of the disaster/s so hopeful that theory proves to be correct over the coming days and weeks, this is a big average down for me in the expectation that over the next 6 or 8 months i can turn my long suffering SUN position around and finally get some closure.

i figured the biggest SP falls happen on the day of the disaster/s so hopeful that theory proves to be correct over the coming days and weeks, this is a big average down for me in the expectation that over the next 6 or 8 months i can turn my long suffering SUN position around and finally get some closure.  SUN is now my biggest single holding making up over 12% of my portfolio.

SUN is now my biggest single holding making up over 12% of my portfolio.

My average Price has come down to $9.06

In very late today at $8.17

i figured the biggest SP falls happen on the day of the disaster/s so hopeful that theory proves to be correct over the coming days and weeks, this is a big average down for me in the expectation that over the next 6 or 8 months i can turn my long suffering SUN position around and finally get some closure.

i figured the biggest SP falls happen on the day of the disaster/s so hopeful that theory proves to be correct over the coming days and weeks, this is a big average down for me in the expectation that over the next 6 or 8 months i can turn my long suffering SUN position around and finally get some closure. My average Price has come down to $9.06

pixel

DIY Trader

- Joined

- 3 February 2010

- Posts

- 5,359

- Reactions

- 345

Re: SUN - Suncorp-Metway

I hope I'm wrong, but on another forum, I explained my view that SUN may still have more downside to come. A chance that it found support at current levels does exist, but I find it rather slim.

The nearest support I can see is around $7.50-$7.60. Look back over the last 12 months, and you'll find it's been supported around those levels from June onwards.

If that support were broken, and I could see some more fundamental reasons coming out of Queensland, the next level would be at least $2 lower. See weekly chart.

Currently, I don't have any position, neither Long nor Short; at this stage, I'd be reluctant to bid more than $7.50, and even that bid would be pulled if the drop continued too fast for my liking.

Good luck, S_C,In very late today at $8.17i figured the biggest SP falls happen on the day of the disaster/s so hopeful that theory proves to be correct over the coming days and weeks, this is a big average down for me in the expectation that over the next 6 or 8 months i can turn my long suffering SUN position around and finally get some closure.

SUN is now my biggest single holding making up over 12% of my portfolio.

My average Price has come down to $9.06

I hope I'm wrong, but on another forum, I explained my view that SUN may still have more downside to come. A chance that it found support at current levels does exist, but I find it rather slim.

The nearest support I can see is around $7.50-$7.60. Look back over the last 12 months, and you'll find it's been supported around those levels from June onwards.

If that support were broken, and I could see some more fundamental reasons coming out of Queensland, the next level would be at least $2 lower. See weekly chart.

Currently, I don't have any position, neither Long nor Short; at this stage, I'd be reluctant to bid more than $7.50, and even that bid would be pulled if the drop continued too fast for my liking.

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

Re: SUN - Suncorp-Metway

I must admit it was a very rushed decision on my part and was purely based on my disaster spike/sell down theory, figuring the panic type sellers would of been shaken out of the stock today. :dunno: time will tell all of course.

The nearest support I can see is around $7.50-$7.60. Look back over the last 12 months, and you'll find it's been supported around those levels from June onwards.

I must admit it was a very rushed decision on my part and was purely based on my disaster spike/sell down theory, figuring the panic type sellers would of been shaken out of the stock today. :dunno: time will tell all of course.

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

Re: SUN - Suncorp-Metway

Good luck with it So Cynical. Your approach has worked well for you in the past.

Good luck with it So Cynical. Your approach has worked well for you in the past.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Re: SUN - Suncorp-Metway

Flooding will peak tomorrow so the bad news will only be flushed out fully by early next week I think.

For longer term insurers will simply collect higher premium over time to recoup the payouts for the current event. In fact my understanding is that many people in QLD don't have flood insurance (which requires additional extra).

With SUN however there's still the banking side which will run into trouble as well, with people unable to pay their mortgages / small business loans due to the flood.

I must admit it was a very rushed decision on my part and was purely based on my disaster spike/sell down theory, figuring the panic type sellers would of been shaken out of the stock today. :dunno: time will tell all of course.

Flooding will peak tomorrow so the bad news will only be flushed out fully by early next week I think.

For longer term insurers will simply collect higher premium over time to recoup the payouts for the current event. In fact my understanding is that many people in QLD don't have flood insurance (which requires additional extra).

With SUN however there's still the banking side which will run into trouble as well, with people unable to pay their mortgages / small business loans due to the flood.

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

Re: SUN - Suncorp-Metway

I figure the market is forward thinking enough to factor in the negatives well ahead of the reality....SUN released a Claims Update for South East Queensland at 4.47 PM predicting a pre tax cost of between 130 and 150 mill.

Be interesting to see if the SP hold up tomorrow as well as it did today, holding above the $8 mark as i thought it would...tomorrow is another day.

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9NzcyNDR8Q2hpbGRJRD0tMXxUeXBlPTM=&t=1

Flooding will peak tomorrow so the bad news will only be flushed out fully by early next week I think.

I figure the market is forward thinking enough to factor in the negatives well ahead of the reality....SUN released a Claims Update for South East Queensland at 4.47 PM predicting a pre tax cost of between 130 and 150 mill.

Be interesting to see if the SP hold up tomorrow as well as it did today, holding above the $8 mark as i thought it would...tomorrow is another day.

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9NzcyNDR8Q2hpbGRJRD0tMXxUeXBlPTM=&t=1

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

Re: SUN - Suncorp-Metway

That sounds unreasonably low. And I don't know how they can even begin to anticipate what it might be when the whole Brisbane situation has to far to play out.....SUN released a Claims Update for South East Queensland at 4.47 PM predicting a pre tax cost of between 130 and 150 mill.

- Joined

- 3 July 2009

- Posts

- 28,137

- Reactions

- 25,364

Re: SUN - Suncorp-Metway

Forgive my ignorance, but does flooding come under " act of god " unless otherwise stipulated

Forgive my ignorance, but does flooding come under " act of god " unless otherwise stipulated

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

Re: SUN - Suncorp-Metway

I think its an act of god...unless of course the drains over fill, cant cope or get blocked then its an act of incompetence or bad planning not gods.

--------------------------------------

$8.05 was the bottom on Wednesday then Thursday saw a top of $8.50 and today's close $8.40 would suggest that the worst is over and looks like my bottom pick was about right....$9.50 here we come.

Forgive my ignorance, but does flooding come under " act of god " unless otherwise stipulated

I think its an act of god...unless of course the drains over fill, cant cope or get blocked then its an act of incompetence or bad planning not gods.

--------------------------------------

(Tuesday) In very late today at $8.17i figured the biggest SP falls happen on the day of the disaster/s so hopeful that theory proves to be correct over the coming days and weeks.

$8.05 was the bottom on Wednesday then Thursday saw a top of $8.50 and today's close $8.40 would suggest that the worst is over and looks like my bottom pick was about right....$9.50 here we come.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Re: SUN - Suncorp-Metway

Many people don't have insurance period. SUN should be able to quite quickly calculate how many policies they hold in the affected areas and how much each is insured in terms of content insurance. In fact, they should have models suggesting what the payout of certain flood events should be - that's how they work out the premium in the first place.

IAG brands policies don't offer flood insurance as standard, whereas SUN does. Some SUN guy just went on TV to say they are covered regardless whether the water comes from above, below, left or right... there is no debate whether it's flood, storm water, man made error or act of God.

I am guessing that IAG will lose some market share in the long term as people get angry about not being covered, whereas SUN will get more business at a higher premium. (Although I think they mis-priced this event).

That sounds unreasonably low. And I don't know how they can even begin to anticipate what it might be when the whole Brisbane situation has to far to play out.

Many people don't have insurance period. SUN should be able to quite quickly calculate how many policies they hold in the affected areas and how much each is insured in terms of content insurance. In fact, they should have models suggesting what the payout of certain flood events should be - that's how they work out the premium in the first place.

IAG brands policies don't offer flood insurance as standard, whereas SUN does. Some SUN guy just went on TV to say they are covered regardless whether the water comes from above, below, left or right... there is no debate whether it's flood, storm water, man made error or act of God.

I am guessing that IAG will lose some market share in the long term as people get angry about not being covered, whereas SUN will get more business at a higher premium. (Although I think they mis-priced this event).

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

Re: SUN - Suncorp-Metway

People so often buy insurance based on price alone when really its about the fundamentals...insurance is needed to cover negative events and worst case scenarios and insurance at any price that doesn't cover that, is insurance that's not worth having.

Many people don't have insurance period. SUN should be able to quite quickly calculate how many policies they hold in the affected areas and how much each is insured in terms of content insurance. In fact, they should have models suggesting what the payout of certain flood events should be - that's how they work out the premium in the first place.

IAG brands policies don't offer flood insurance as standard, whereas SUN does. Some SUN guy just went on TV to say they are covered regardless whether the water comes from above, below, left or right... there is no debate whether it's flood, storm water, man made error or act of God.

I am guessing that IAG will lose some market share in the long term as people get angry about not being covered, whereas SUN will get more business at a higher premium. (Although I think they mis-priced this event).

People so often buy insurance based on price alone when really its about the fundamentals...insurance is needed to cover negative events and worst case scenarios and insurance at any price that doesn't cover that, is insurance that's not worth having.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Re: SUN - Suncorp-Metway

Secondary effects of the flood surfacing...

http://www.theaustralian.com.au/bus...of-loans-at-risk/story-e6frg8zx-1225990589981

Secondary effects of the flood surfacing...

http://www.theaustralian.com.au/bus...of-loans-at-risk/story-e6frg8zx-1225990589981

THE Queensland floods crisis could put nearly $5 billion worth of mortgages and commercial loans at risk of default, as the financial fallout mounts from the worst natural disaster in the state in nearly three decades.