Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 9,841

- Reactions

- 6,823

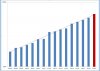

It appears to me that the share price is still reasonable and in the end that is what matters.

I would be expecting 250% growth of profit with 120% increase in sales over the next few years.

It appears realistic to me. Do you guys agree?

I would be expecting 250% growth of profit with 120% increase in sales over the next few years.

It appears realistic to me. Do you guys agree?