- Joined

- 8 June 2008

- Posts

- 13,405

- Reactions

- 19,834

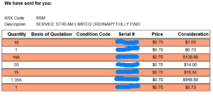

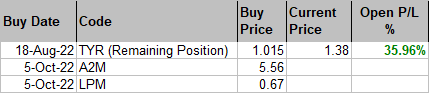

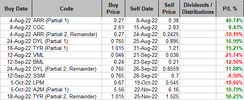

Missed my TYR entry a week ago and still regretting it. Well done !!!Sold half of the shares in TYR:

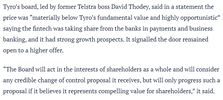

View attachment 146208

Also congratulations to @UMike for being the runner up with the August Stock Tipping Competition tipping TYR: https://www.aussiestockforums.com/threads/august-2022-stock-competition-entries.37168/post-1190801

Hope the remaining shares for TYR sticks on, in this portfolio for some time... ?

As previously mentioned, TYR business model does not entirely rely on cheap credit, as it provides payment solutions for business especially small business with Point-Of-Sale (POS) terminals for taking credit/debit card payments. When we had the near-zero interest rates for the last few years, I was quite happy to frequently add Buy-Now-Pay-Later (BNPL) stocks to this portfolio as they thrived in a cheap credit environment.

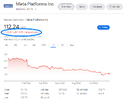

I am sure you guys remember the mammoth of the BNPL space Afteray (APT) ? It had an epic share price increase before being acquired by US based payments company Square Inc. Below is a summary from Google:

View attachment 146207

Other than the banks that offer their payment solutions for businesses, as far as I can see there isn't a Square/Block Inc. equivalent on the asx, other than Tyro Payments Ltd (TYR). So TYR could be somewhat unique in that regard.

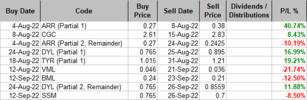

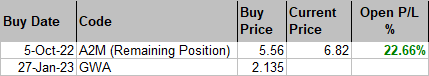

Closed Positions:

View attachment 146210