- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

Sometimes I visit some of the individual stock threads to get some inspiration to research stocks. Even then the best of the stock ideas don't get handed on a silver platter, it takes hard work and research to separate the wheat from the chaff.

So I'd like to acknowledge @frugal.rock for initially coming across today's portfolio addition. He is quite active in the small end of the market from what I've come across and usually I pass on a lot of those microcaps. But I read some comments on the HT8 thread recently and it looked like a company worth investigating further...

This profitable little small cap is a rare find in the online marketplace. It is the Number 1 marketplace seller on Amazon Australia. Going by the user reviews, Harris Technology Group Ltd (HT8) is doing a great job of selling technology products to it's customers.

As most of you know, Amazon is in it's infancy in Australia and there is huge market expansion still ahead of us, below is a little history...

So as Amazon expands across the country, imagine the growth HT8 could experience over the coming years as it grows alongside Amazon and what if it expands while keeping number 1 status...

BTW, HT8 is not limited to selling on the Amazon platform, it has it's sales channels spread across the main online marketplaces.

Financial summary shows the outstanding growth it's experiencing.

Although I came across this stock a few days ago as mentioned, it took me a while to look at the company in detail and I also wanted to see a little more convincing strength in the price action of it's shares. Today's move in share price with high volume was a good signal for me to purchase some shares for this portfolio.

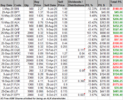

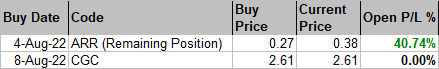

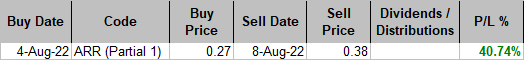

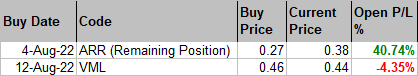

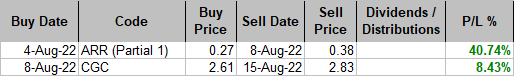

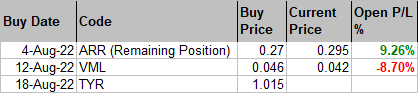

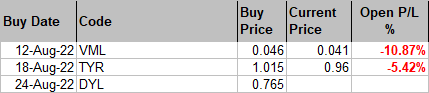

Open Portfolio:

So I'd like to acknowledge @frugal.rock for initially coming across today's portfolio addition. He is quite active in the small end of the market from what I've come across and usually I pass on a lot of those microcaps. But I read some comments on the HT8 thread recently and it looked like a company worth investigating further...

This profitable little small cap is a rare find in the online marketplace. It is the Number 1 marketplace seller on Amazon Australia. Going by the user reviews, Harris Technology Group Ltd (HT8) is doing a great job of selling technology products to it's customers.

As most of you know, Amazon is in it's infancy in Australia and there is huge market expansion still ahead of us, below is a little history...

So as Amazon expands across the country, imagine the growth HT8 could experience over the coming years as it grows alongside Amazon and what if it expands while keeping number 1 status...

BTW, HT8 is not limited to selling on the Amazon platform, it has it's sales channels spread across the main online marketplaces.

Financial summary shows the outstanding growth it's experiencing.

Although I came across this stock a few days ago as mentioned, it took me a while to look at the company in detail and I also wanted to see a little more convincing strength in the price action of it's shares. Today's move in share price with high volume was a good signal for me to purchase some shares for this portfolio.

Open Portfolio: