- Joined

- 5 August 2021

- Posts

- 320

- Reactions

- 700

Hey,

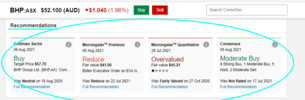

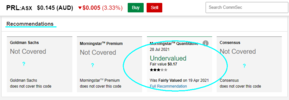

Just curious to find out where some of you guys read about the stocks you are investing outside of there general announcements. I currently read a mix of the motley fool, (however I have heard in recent months that they aren't a very good source), Simply Wall Street and Australian based news such as the ABC.

Looking forward to hearing where some of you guys do your reading/if you read outside of the general announcements of the company.

I am new here so apologies if I have structured this wrong / am in the wrong section.

Just curious to find out where some of you guys read about the stocks you are investing outside of there general announcements. I currently read a mix of the motley fool, (however I have heard in recent months that they aren't a very good source), Simply Wall Street and Australian based news such as the ABC.

Looking forward to hearing where some of you guys do your reading/if you read outside of the general announcements of the company.

I am new here so apologies if I have structured this wrong / am in the wrong section.