- Joined

- 23 July 2008

- Posts

- 930

- Reactions

- 0

Re: SILVER

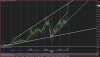

The Silver Log (11.18.2010) - Five percent gain sending the intermediate status to neutral

endlessmountain | 18 November 2010 | 20 likes, 0 dislikes

http://thesilverlog.blogspot.com

The Silver Log (11.18.2010) - Five percent gain sending the intermediate status to neutral

endlessmountain | 18 November 2010 | 20 likes, 0 dislikes

http://thesilverlog.blogspot.com