- Joined

- 1 February 2006

- Posts

- 568

- Reactions

- 7

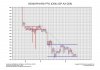

Too many analysts dropping their value of SIP and most saying they dont believe Sigma will even meet its next target.

Im struggling to see any upside to Sigma in the next 12 months, after that no doubt it could pick up.

Im all out for 1.39. Nasty loss but oh well, cant win them all. Just gotta win most.

Im struggling to see any upside to Sigma in the next 12 months, after that no doubt it could pick up.

Im all out for 1.39. Nasty loss but oh well, cant win them all. Just gotta win most.