So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,467

- Reactions

- 1,469

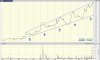

(19th-October-2011)In today at $1.76 ~ portfolio stock #24 ~

I got most of my $1.95 sell order filled on Tuesday but the SP never got back to $1.95 to see my order completed..oh well, so i have decided to hold on to a few extra SGH shares, trade profit was 9.62% and i received 1 FF dividend of 2.5c (3.25 gross) so overall a 11.5% result for holding 10 months...not to shabby.

With the small (parcel) average down i took in March (1.505) the average price of my remaining shares is $1.71 ~ i have posted a 12 month chart of my activity's...keen to re enter below $1.70.

Closed Trade #91

Still lots to like about investing with lawyers.

~