You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Scalping FX with Cyrox Rainbow

- Thread starter tayser

- Start date

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

20 pips? two days trades... one beer for me, two for you

wah, 2 beers only ? should be worth a few fireworks at least

so far, correct me if I am wrong, the best setup would be NinjaTrader free account, EFX/MBT trading account

most popular pair seems to be AUD/JPY - haven't really played with much else - but you sort of get to know and get comfortable with a pair set

just stick to one pair. if you find you're having trouble with AUD/JPY, go with EUR/JPY.

yes, I recommend the NINJA + EFX/MBT setup (you need 2x demo accounts from EFX/MBT if you decide to have navigator as the execution platform (you can execute on ninja however))

yes, I recommend the NINJA + EFX/MBT setup (you need 2x demo accounts from EFX/MBT if you decide to have navigator as the execution platform (you can execute on ninja however))

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

just stick to one pair. if you find you're having trouble with AUD/JPY, go with EUR/JPY.

yes, I recommend the NINJA + EFX/MBT setup (you need 2x demo accounts from EFX/MBT if you decide to have navigator as the execution platform (you can execute on ninja however))

are you live yet tayser?, if not - when do you expect to go live? I do feel that going live will certainly take out a lot of the blaise risk taking moves

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Here is my breakdown for my 2nd week of serious demoing.

Overall profit - 15pips (10 pips off weekly target)

9 winners. Average win = 4.55

7 losers. Average loss = -3.7pips

Any comments appreciated

Prawn I find the scatter charts very helpful. They tell a lot about your trading.

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

Prawn I find the scatter charts very helpful. They tell a lot about your trading.

Yeh i got the idea from you

I think they are telling me i do not have enough big winners ie 8 - 10 pips.

Something to work towards...

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Yeh i got the idea from you

I think they are telling me i do not have enough big winners ie 8 - 10 pips.

Something to work towards...

Yeah they are important to hit some home runs with scalping. They really make a big diff to a good week or just another week. They really push up the averages in you favour.

As you get more comfortable with the system and build profitability you can start letting some trades run as you just move your mental stop to break even then to 8 pips then to 16 etc.

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

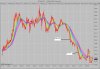

Perfect way to start the week  if i was live I would stop now, but since I am on uni break, i was planning to trade all day to get some practice.

if i was live I would stop now, but since I am on uni break, i was planning to trade all day to get some practice.

Long 1: +3

Should have held this longer, but .5 was my target, and the overall trend is down so i wasnt too comfortable holding.

19:53:49 AUD/JPY Executed Bought 10000 AUD/JPY at 93.46

19:59:28 AUD/JPY Executed Sold 10000 AUD/JPY at 93.50

Short 1: -2

Again probably should have held on, but thought it was going against me so got out, as the rule says.

20:05:43 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.58

20:09:03 AUD/JPY Executed Bought 10000 AUD/JPY at 93.59

Short 2: +4

Textbook trade. Break through .5, flame widening.

20:12:11 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.49

20:13:39 AUD/JPY Executed Bought 10000 AUD/JPY at 93.44

Short 3: +7

I was already at my daily target, but it broke through very strong resistance at .4 so i jumped in. Amazing how quickly it can move when major points are broken.

20:17:03 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.37

20:17:49 AUD/JPY Executed Bought 10000 AUD/JPY at 93.29

Long 1: +3

Should have held this longer, but .5 was my target, and the overall trend is down so i wasnt too comfortable holding.

19:53:49 AUD/JPY Executed Bought 10000 AUD/JPY at 93.46

19:59:28 AUD/JPY Executed Sold 10000 AUD/JPY at 93.50

Short 1: -2

Again probably should have held on, but thought it was going against me so got out, as the rule says.

20:05:43 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.58

20:09:03 AUD/JPY Executed Bought 10000 AUD/JPY at 93.59

Short 2: +4

Textbook trade. Break through .5, flame widening.

20:12:11 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.49

20:13:39 AUD/JPY Executed Bought 10000 AUD/JPY at 93.44

Short 3: +7

I was already at my daily target, but it broke through very strong resistance at .4 so i jumped in. Amazing how quickly it can move when major points are broken.

20:17:03 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.37

20:17:49 AUD/JPY Executed Bought 10000 AUD/JPY at 93.29

Attachments

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

Found other things to do today so I didnt trade anymore today up until now.

Broke down quickly through heavy resistance, got bad slippage, but still managed to pick up 6 pips

18 pips all up today, my best day so far.

I'll go live when i can be this consistent... Maybe a long way off

Im not trading anymore today, even though im demoing. I want to try and keep this form, lol.

02:54:56 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.10

02:56:34 AUD/JPY Executed Bought 10000 AUD/JPY at 93.03

Broke down quickly through heavy resistance, got bad slippage, but still managed to pick up 6 pips

18 pips all up today, my best day so far.

I'll go live when i can be this consistent... Maybe a long way off

Im not trading anymore today, even though im demoing. I want to try and keep this form, lol.

02:54:56 AUD/JPY Executed Sold Short 10000 AUD/JPY at 93.10

02:56:34 AUD/JPY Executed Bought 10000 AUD/JPY at 93.03

Attachments

Demo platform is its flakey self once again - bout a 2 second lag between the charts and quotes.

Time Order ID Message Event TIF Orig Trader ID

17:55:51 0xc002s:0c6z-00 Sell Short 300000 AUD/JPY @ Market on MBTX [expiring: 14/07/2008] (300000 traded at 92.90) Filled GTC

17:56:20 0xc002s:0c83-00 Buy 300000 AUD/JPY @ Market on MBTX [expiring: 14/07/2008] (300000 traded at 92.85) Filled GTC

Time Order ID Message Event TIF Orig Trader ID

17:55:51 0xc002s:0c6z-00 Sell Short 300000 AUD/JPY @ Market on MBTX [expiring: 14/07/2008] (300000 traded at 92.90) Filled GTC

17:56:20 0xc002s:0c83-00 Buy 300000 AUD/JPY @ Market on MBTX [expiring: 14/07/2008] (300000 traded at 92.85) Filled GTC

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

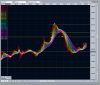

EFX demo is taking about 1 - 2 seconds to process orders, so giving massive slippage. I clawed my way back to positive and hopefully the demo is better tomorrow night...

Long 1: +1

Entered on break of .00, didnt feel comfortable holding for some reason so only took a small profit.

Short 1: -3

Tried for the early entry, but wasnt quick enough with the exit.

Short 2: -4

Actually entered this at .99 but ended up getting filled at .95. Worse slippage i have had with EFX. Should have got out at b/e in hindsight.

Short 3: +7

Overall trend was down. Was in holding pattern with rainbow turning. Didnt expect the move to be so fast though

Short 4: b/e

Was lucky here. Again the fills were crap so i was an idiot for taking the trade...

Long 1: +1

Entered on break of .00, didnt feel comfortable holding for some reason so only took a small profit.

Short 1: -3

Tried for the early entry, but wasnt quick enough with the exit.

Short 2: -4

Actually entered this at .99 but ended up getting filled at .95. Worse slippage i have had with EFX. Should have got out at b/e in hindsight.

Short 3: +7

Overall trend was down. Was in holding pattern with rainbow turning. Didnt expect the move to be so fast though

Short 4: b/e

Was lucky here. Again the fills were crap so i was an idiot for taking the trade...

Attachments

3 trades tonight:

1) not too sure why I took this one, I felt bad about it after taking it and decided to get out. Ended up getting out for a profit just before a breakout - go figure. +2.6pips

2) went for a reversal trade here (not sure the correct term). When it didn't reverse quickly as it had done previously tonight, I decided to get out for a small loss. -1.3 pips

3) price broke down just before 20:10 so i jumped in short on the pullback. These are the high probability trades I want to learn to have patience for.

+10.8pips

Trading over tonight. Good news is for the first 2 trades I was only trading 10k lots then bumped it up to 20k for the third!

1) not too sure why I took this one, I felt bad about it after taking it and decided to get out. Ended up getting out for a profit just before a breakout - go figure. +2.6pips

2) went for a reversal trade here (not sure the correct term). When it didn't reverse quickly as it had done previously tonight, I decided to get out for a small loss. -1.3 pips

3) price broke down just before 20:10 so i jumped in short on the pullback. These are the high probability trades I want to learn to have patience for.

+10.8pips

Trading over tonight. Good news is for the first 2 trades I was only trading 10k lots then bumped it up to 20k for the third!

Attachments

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

1) not too sure why I took this one, I felt bad about it after taking it and decided to get out. Ended up getting out for a profit just before a breakout - go figure. +2.6pips

2) went for a reversal trade here (not sure the correct term). When it didn't reverse quickly as it had done previously tonight, I decided to get out for a small loss. -1.3 pips

3) price broke down just before 20:10 so i jumped in short on the pullback. These are the high probability trades I want to learn to have patience for.

+10.8pips

Here's another relatives newbs opinion

1st trade: Personally i would have entered when it broke 160 (previous high) pretty much where you ended up exiting.

2nd Trade: I used to try for contrarian/reversal trades all the time. Now i have found its better to wait for a defined move than guess/hope

3rd trade: good work

Hope that helps

Nice trades mate, if you guys dont mind i might start posting my trades here as well. Got home late so nothing tonight so far. I am watching the EUR USD and EUR JPY mainly.

The more the merrier!

Here's another relatives newbs opinion

1st trade: Personally i would have entered when it broke 160 (previous high) pretty much where you ended up exiting.

2nd Trade: I used to try for contrarian/reversal trades all the time. Now i have found its better to wait for a defined move than guess/hope

3rd trade: good work

Hope that helps

1) yes I prob should of jumped back in here but I think I was a little shell shocked for my judgment to have been off. Im actually trading a small live account as I want to feel the gains and losses

3) thankyou! would like these more often

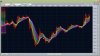

1st trade:

Price broke above 161.20 and I jumped in. Pulled back a bit but wasnt doing anything so I got out. I think this is a really good example of getting out if a trade isnt going your way, you can see what happened to the price shortly afterwards. -3.9pips

(didnt get in on that massive downspike as it was moving way too fast for me)

2nd trade:

Price broke down and I jumped in on the pullback. Missed the spike down and as the big even 161.00 was just above me i thought this would head back up. Exited for a small profit. +1pip

3rd trade:

broke up above resistance at about 161.00 and jumped in on the pullback shortly after 20:35. Previously had been choppy so I thought it would continue zagging up. Again didn't really do anything so closed out for a small profit after getting uncomfortable with the trade. +1pip

4th trade:

Price broke out just before 21:00 so i jumped in right on 21:00 after it had pulled back a bit and purple area was starting to show. Jumped up quickly so I took my profit. +9.3pips

Price broke above 161.20 and I jumped in. Pulled back a bit but wasnt doing anything so I got out. I think this is a really good example of getting out if a trade isnt going your way, you can see what happened to the price shortly afterwards. -3.9pips

(didnt get in on that massive downspike as it was moving way too fast for me)

2nd trade:

Price broke down and I jumped in on the pullback. Missed the spike down and as the big even 161.00 was just above me i thought this would head back up. Exited for a small profit. +1pip

3rd trade:

broke up above resistance at about 161.00 and jumped in on the pullback shortly after 20:35. Previously had been choppy so I thought it would continue zagging up. Again didn't really do anything so closed out for a small profit after getting uncomfortable with the trade. +1pip

4th trade:

Price broke out just before 21:00 so i jumped in right on 21:00 after it had pulled back a bit and purple area was starting to show. Jumped up quickly so I took my profit. +9.3pips

Attachments

Similar threads

- Replies

- 3

- Views

- 865

- Poll

- Replies

- 258

- Views

- 21K