prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

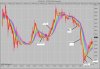

this was from about an hour ago.

Ended up breaking even.

At this stage im working on my entries. Another couple weeks and i'll try to combine my entries and exits together. one step at a time, im in no rush to start with real cash...

Short 1:

Was looking for a breakdown (obviously). Also looked possible from the 1 min chart.

That spread really does kill you when you get something wrong

Short 2:

Entered waiting for a break of support. trend was down and pink WMAs were spreading. Decent entry, didnt hang on long enough (again)

Long 1:

It had dropped like a stone and i was looking for a rally back up. Got 1 pip nett out of it, which i was happy with, as i didnt know if it would continue downwards. I didnt expect it to rally as high as it did, although i guess it makes sense...

Feel free to comment/critique

Ended up breaking even.

At this stage im working on my entries. Another couple weeks and i'll try to combine my entries and exits together. one step at a time, im in no rush to start with real cash...

Short 1:

Was looking for a breakdown (obviously). Also looked possible from the 1 min chart.

That spread really does kill you when you get something wrong

Short 2:

Entered waiting for a break of support. trend was down and pink WMAs were spreading. Decent entry, didnt hang on long enough (again)

Long 1:

It had dropped like a stone and i was looking for a rally back up. Got 1 pip nett out of it, which i was happy with, as i didnt know if it would continue downwards. I didnt expect it to rally as high as it did, although i guess it makes sense...

Feel free to comment/critique