Cheers the one thing I am certain of is the buy decision will look either smart or dumb at some point in the future.

Probably look both smart and dumb just at different points in time.

Cheers the one thing I am certain of is the buy decision will look either smart or dumb at some point in the future.

Robusta,

After perusing a couple of pages of this thread, I just realised something that you may not have considered. SRX.

Sirtex and HHL are rather tied together in performance, the CEO of Hunter-Hall mentioned the good performance of SRX as a large contributing factor in the funds overall performance in the half yearly report. To me it signalled that the people at HHL were getting desperate for performance, betting on some above market returns to improve their standing and therefore business. When a business starts taking on large 'bets', it is usually not a good sign.

The fact that the share price of HHL is at multy year lows, below the GFC bottom should send up alarm bells about it, not as something to load up on. If my analysis is close to correct, you have now added into the biggest loser in your portfolio, while taking profits on a winner like MTU. The total invested dollars is greatest in HHL, the worst performer.

Your decision to invest more in HHL while dumping MTU may turn out to be a good one, however one of the weakness of such outcomes is that it increases confidence that such actions are profitable (adding to losers and selling winners), therefore next time the same situation arises, same decision.

These type of actions lead to the possibility that when an overall market correction comes along, you will have most money invested in the biggest losers while the rest is in cash, of course in the need for performance, more gets invested in the losers. This then leads to phychological pressures about the losses if/when the market continues down. The typical selling of all positions often comes near the market bottom to relieve the pain.

My suggestion is that you review your entire investment strategy plus your original goals and aims. It is something we all need to do on a regular basis. We all make mistakes and the trick in investment is to keep the mistakes small.

Robusta,

The numbers do not look correct, so I added your current portfolio. I get a total of $34,492.96 not $37,492.96.

Just noticed, your total for nvt 1023 shares at $5.77 = $2,902.71 not the correct $5,902.77, the total then adds up.

It is important to keep the little details in the spreadsheet accurate.

Looking from the outside, you have a profit of $3,514.60, yet if you had just saved the $50/week you would have $4,750, is this correct? It has cost $1,200 to get a little education in the real market. This is fairly cheap compared to most.

If I can be so bold to make a couple of comments. Firstly apart from the obvious mistake of having the largest number of dollars invested in the biggest loser, HHL there is also the position in EZL.

EZL went up by 30% in a short period of time, 7 months after you purchase it, yet it is still on your books as a loss now. There is a saying in investment about never letting a profit turn into a loss. This seems to be what you have done here. Similar with IPP, though not as prominent.

From the bleachers I see that you have added twice to the biggest loser HHL and not at all to the biggest winners in NTV +MTU (the second purchase in MTU only raised the invested funds to ~$2500 and at similar price to the first purchase). The amount of cash invested in the biggest winners is less than half that invested in the biggest loser. This pattern does not a make profitable portfolio.

Your stock selection and timing for entry has been pretty sound in hindsight, yet your trading of these stocks could have led to a vastly different performance. Have used your existing entry scenarios and tested some different trading scenarios of the same portfolio, such as adding to winners and cutting losers, or running a trailing stop loss and re-entry at some lower prices (percentage, support, whatever)??

There is always more homework with investing...

NEW INVESTMENT

EZL - Euroz Limited

Bought 1412 @ $1.055 = $1489.66

Well I just like the way these guys allocate capital, the holdings in OZG & WIC are a bonus, also good leverage to any possible rebound in world growth.

Fully invested now, need some dividends if I am going to buy anymore - lucky for me tis the season.

Nice little milestone for this portfolio today, managed to hold on to a investment in a company for 12 months.

Really should include brokerage in the costing so in total $3680.73 has been invested in this company, no dividend has been paid yet on the converted shares but two $0.09 dividends have been received for a return of $200.70 this gives me a yield of ~5.45% plus $86.02 in franking credits. The cost of my capital through the line of credit is currently 6% so that is a fail on that first hurdle.

To use some ratings agency speak I currently have this company on a "negative watch", after the major acquisition in May I understand debt will be higher, ROE and EPS will be lower for the most recent reporting period. In the absence of any surprises in the Annual report I will be watching the interim and following full year report to see debt being paid down and returns increasing. Before May I would not have considered selling below ~$4.25 now $3.80 + would give me something to think about.

For what it is worth looking at todays closing price of $3.44 the market is offering buy my interest in MTU back for $4791.92

A story like this one rouses some contrarian instincts.

http://www.news.com.au/money/invest...he-party-started/story-e6frfmdr-1226646708819

I took some profits today.

Investment Reduced

Sold 466 X MYU @ $6.11 = $2827.31 for a capital gain of $1598.00

This is a little over a third of my holding sold and brings the MTU investment back to 14.7% of my open portfolio at current prices. Unless the price appreciates markedly from here I will be happy to sit back, collect the dividends and read the next annual report.

Another milestone to the portfolio today it has been two years since MTU was added as an investment. Here is my post from twelve months ago.

Have got (quite) a few of those in my SMSF robusta

Considering nobody is an omniscient investor and will have losses to offset – that’s potentially a very misleading use of a quote.What can I say?

"Nobody ever lost money taking a profit." - Bernard Baruch quotes

I can’t argue with this as a reason for switching to a better alternative.The reason MTU has been picked on twice is I think it is the holding most overvalued with the least competitive advantage in the portfolio.

... potentially a very misleading use of a quote ...

"Continual trimming will turn your money tree into a bonsai." - Craft. ...

"Nobody ever lost money taking a profit." - Bernard Baruch quotes

Considering nobody is an omniscient investor and will have losses to offset – that’s potentially a very misleading use of a quote.

"Continual trimming will turn your money tree into a bonsai." - Craft.

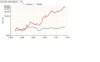

MTU's total return chart.

View attachment 54212

Robusta

I can’t argue with this as a reason for switching to a better alternative.

But I have one question and it doesn’t just relate to this instance and its one I ask myself all the time.

Is your analysis driving your action or is the gut feel inclination to act a particular way driving the analysis?

Cheers

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.