Husband and I are 58 & 55 and aiming to retire within the next few years. I run our smsf portfolio actively, but have lately set aside funds for investing purely into etfs for income streams, without too much regard for capital returns. My intention is for those holdings to be very long term and to provide a steady income - more or less what a term deposit used to do a decade ago. I presently hold both STW and VTS within the actively managed portfolio, and have added YMAX as a long term income hold, and am considering adding HVST as a long term hold also. I do wonder what effect a considerable market downturn would have on the income streams of both YMAX and HVST. As we are presently in accumulation phase the primary focus of our actively managed portfolio is capital growth/preservation and I think I would find it difficult to simply sit on an ETF and watch its value diminish, but I guess if its purpose was to provide an income stream that is what I should do? I do so wish I could just stash our liquid funds in a term deposit and watch it double in value over 7 years like my parents did...….

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement Stocks 2019

- Thread starter Muschu

- Start date

If you look at the long term chart of YMAX & HVST it's price is down hill.HVST high a few yars ago of $26 now around $14-$15. I held HVST from listing & was glad to get rid of it, yes it pays monthly & pays well but there were articles a while ago that to get these returns capital was also being returned as div's., think even Betashares mentioned this.Beware yield trap,higher returns, higher risk. Some prefer PL8, don't know much about this. My preference now is for index tracking etf's & old school lic's ie. arg,mlt ,afic etc. Lower but steady returns & even during the GFC while share price was hammered, the div's only lowered marginally. These might be boring but I do like to sleep at night.Husband and I are 58 & 55 and aiming to retire within the next few years. I run our smsf portfolio actively, but have lately set aside funds for investing purely into etfs for income streams, without too much regard for capital returns. My intention is for those holdings to be very long term and to provide a steady income - more or less what a term deposit used to do a decade ago. I presently hold both STW and VTS within the actively managed portfolio, and have added YMAX as a long term income hold, and am considering adding HVST as a long term hold also. I do wonder what effect a considerable market downturn would have on the income streams of both YMAX and HVST. As we are presently in accumulation phase the primary focus of our actively managed portfolio is capital growth/preservation and I think I would find it difficult to simply sit on an ETF and watch its value diminish, but I guess if its purpose was to provide an income stream that is what I should do? I do so wish I could just stash our liquid funds in a term deposit and watch it double in value over 7 years like my parents did...….

tinhat

Pocket Calculator Operator

- Joined

- 1 May 2009

- Posts

- 1,756

- Reactions

- 768

I do wonder what effect a considerable market downturn would have on the income streams of both YMAX and HVST.

I'm not giving advice here but crickey, YMAX and HVST don't seem like good investments to me. I owned YMAX for a while in the SMSF with the idea that it would be small hedge in the event of a bearish market. Lucky I got out after scalping some income without a loss to my capital.

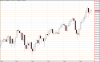

IMHO, these funds are dividend traps. They attract you with the high yield, but what is the sense of gaining a high yield on an ever diminishing capital value? 100% of nothing is nothing. See charts below.

I follow an investment thesis that it is better to hold bank shares as a proxy to bank deposits. I believe this thesis has proven to be correct over the long term. All up across the three portfolios I manage for my family I have invested a decent amount of money into bank shares. One portfolio is 100% bank shares (it was bank and retail for many years). Another is about 20% bank shares and another zero percent bank shares.

YMAX

HVST

tinhat

Pocket Calculator Operator

- Joined

- 1 May 2009

- Posts

- 1,756

- Reactions

- 768

Zaxon

The voice of reason

- Joined

- 5 August 2011

- Posts

- 800

- Reactions

- 881

You said that eloquently. So many people see dividends/distributions as free money. The reality is, it all comes from an equivalent decrease in your share or ETF price. Profit is the better thing to be chasing.If you look at the long term chart of YMAX & HVST it's price is down hill. but there were articles a while ago that to get these returns capital was also being returned as div's., think even Betashares mentioned this.

tinhat

Pocket Calculator Operator

- Joined

- 1 May 2009

- Posts

- 1,756

- Reactions

- 768

- Joined

- 3 July 2009

- Posts

- 27,505

- Reactions

- 24,331

Dock I tend to agree with Monkton, I run my own SMSF and have only LICs, shares and cash, I have steered away from ETFs.

From my understanding, they distribute all income and in the event of a large market correction, they become very exposed to the loses. Only my understanding, but I'm sure I'll be corrected if I'm wrong.

But having said that, I'm sure over the last few years people have made a bomb on ETFs, so there is no right or wrong, just what a person is comfortable with.

We all hope our choices work out and everyone's ideas are welcomed here.

From my understanding, they distribute all income and in the event of a large market correction, they become very exposed to the loses. Only my understanding, but I'm sure I'll be corrected if I'm wrong.

But having said that, I'm sure over the last few years people have made a bomb on ETFs, so there is no right or wrong, just what a person is comfortable with.

We all hope our choices work out and everyone's ideas are welcomed here.

ETFs....they distribute all income

As a Trust, ETFs are required to distribute income. Also they are open ended and I understand units subject to redemption (or purchase) in the primary market - those listed on the ASX are in the secondary market.

Probably, depending on the type of ETF (inverse, sector, involved in options, etc) the vanilla ETFs are no more or less exposed to market correction than the market itself.

A number of those who were invested, mainly retail more than likely, went things went south around 2008 had a panic attack, especially when the distributions were reduced by some 50%. However, there is one argument the distributions prior to that were abnormally high and the underlying distributions, using STW for arguments sake as it's been around the longest, taken from 2002 to current is upward.

As an aside, I thought that period was the best time ever and was filling my boots with as much as I could grab hold of. Sold nothing bought what I could although I swapped STW for VAS in 2010 - no requirement to target smaller companies sector because VAS more than likely has them.

I don't hold any direct shares and take no great interest in the market. The LICs I hold do that job and a relatively active while the ETFs are indifferent (in goes the good, out goes the bad.)

I avoid like the plague any which specialise (high yield, blah, blah, blah) as usually they have higher fees which have an impact longer term as well as being too narrow a focus which, in my view, increases the risk.

Thanks Zaxon, though I do prefer the div's of Lic's, they don't have to payout 100% of income, but keep some to re-invest & some to smooth out div's in 'low times', also I'learned the hard way I'm no good at the 'profit' thing.You said that eloquently. So many people see dividends/distributions as free money. The reality is, it all comes from an equivalent decrease in your share or ETF price. Profit is the better thing to be chasing.

I'm old school so dividends come from free cash glow while capital comes from the shareholders equity account, is classed as Return of Capital and usually requires a Class Ruling from the ATO.

Any company or organisation which uses capital for supporting the divided I will not touch, AMIT aspects being the exception. I have heard of those who do this but I don't know any specifically since I don't look for them.

Any company or organisation which uses capital for supporting the divided I will not touch, AMIT aspects being the exception. I have heard of those who do this but I don't know any specifically since I don't look for them.

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,237

- Reactions

- 8,482

Husband and I are 58 & 55 and aiming to retire within the next few years. I run our smsf portfolio actively, but have lately set aside funds for investing purely into etfs for income streams, without too much regard for capital returns. My intention is for those holdings to be very long term and to provide a steady income - more or less what a term deposit used to do a decade ago. I presently hold both STW and VTS within the actively managed portfolio, and have added YMAX as a long term income hold, and am considering adding HVST as a long term hold also. I do wonder what effect a considerable market downturn would have on the income streams of both YMAX and HVST. As we are presently in accumulation phase the primary focus of our actively managed portfolio is capital growth/preservation and I think I would find it difficult to simply sit on an ETF and watch its value diminish, but I guess if its purpose was to provide an income stream that is what I should do? I do so wish I could just stash our liquid funds in a term deposit and watch it double in value over 7 years like my parents did...….

When you sit on a Term Deposit, you are guaranteed to watch its value diminish, no in actual dollar terms, but inflation will be eating away at your buying power steadily each year.

If you instead owned a the asx 200 index and the world index, you would be getting a cashflow return that was higher than the Term Deposit, and your capital value would “over time” see real growth in excess of inflation.

The question to ask your self is would you rather an average return of 2% per year that was steady or one of 8% but was volatile, eg 15% this year -2% next year etc.

—————

The way to manage your emotions during fluctuations is to stop thinking of your investment as being a price that is bouncing around, but think of the actual businesses you own, and don’t think short term.

If I gave you ownership of 1% of every business in the world, would you worry about the short term ups and Downs?

No you wouldn’t, you would just sit on it, collect the dividends and live life.

Consistently allocating funds into the world index is just really trying to buy yourself into the situation of owning a chunk of every business

Yes etf's have to distribute all income, lic's keep some to re-invest & some to smooth out div payment in low times.Dock I tend to agree with Monkton, I run my own SMSF and have only LICs, shares and cash, I have steered away from ETFs.

From my understanding, they distribute all income and in the event of a large market correction, they become very exposed to the loses. Only my understanding, but I'm sure I'll be corrected if I'm wrong.

But having said that, I'm sure over the last few years people have made a bomb on ETFs, so there is no right or wrong, just what a person is comfortable with.

We all hope our choices work out and everyone's ideas are welcomed here.

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,237

- Reactions

- 8,482

Dock I tend to agree with Monkton, I run my own SMSF and have only LICs, shares and cash, I have steered away from ETFs.

From my understanding, they distribute all income and in the event of a large market correction, they become very exposed to the loses. Only my understanding, but I'm sure I'll be corrected if I'm wrong.

But having said that, I'm sure over the last few years people have made a bomb on ETFs, so there is no right or wrong, just what a person is comfortable with.

We all hope our choices work out and everyone's ideas are welcomed here.

To me, it’s not about whether something is an ETF or any other security.

it’s 100% about what underlying assets I own when I buy the security and how is it being managed.

Zaxon

The voice of reason

- Joined

- 5 August 2011

- Posts

- 800

- Reactions

- 881

lol. OK. I feel summoned. The major differences between ETFs vs LICs is transparency, and active vs passive management. ETF can mean any Exchange Traded Product, but let's focus on index funds, which is what most people think of when they hear ETF.I run my own SMSF and have only LICs, shares and cash, I have steered away from ETFs.

From my understanding, they distribute all income and in the event of a large market correction, they become very exposed to the loses. Only my understanding, but I'm sure I'll be corrected if I'm wrong.

Index ETFs

- Are a passively held index

- Very transparent about their holdings

- If you want to own the pure index, you can!

- Are incredibly cheap to own

- They are a trust structure

- All dividends are distributed to their holders in the same year

- Are a more modern structure

- Are an actively managed fund (not passive)

- They may or maynot being trying to copy an index

- Are more of a "black box". They may reveal their holdings. They may not

- Inherently have a lot more internal fees than an ETF, because somebody has to pay for all those active managers

- They are a company structure

- They may (or may not) smooth out distributions by retaining profits until later years. Eventually, it should all get paid out

- In a sense, are more old fashioned than ETFs.

Because LICs hold shares in other listed companies, they're inherently exposed to the market in exactly the same way an ETF is. If the market crashes, LICs crash along with it. They may smooth returns by withholding distributions. That means they're deliberately witholding your dividends so they can give them to you in a future year.

- Joined

- 8 June 2008

- Posts

- 13,015

- Reactions

- 19,117

Interesting article on why lics may not stack up to efthttps://blog.stockspot.com.au/compare-lic-vs-etf/

A problem now is that some eft are quite managed, a la LICand

Plus you may need some management when markets are in free fall , so boom time may see different winners

A problem now is that some eft are quite managed, a la LICand

Plus you may need some management when markets are in free fall , so boom time may see different winners

A problem now is that some eft are quite managed, a la LIC

Vanguard has had actively managed funds many years and now a few ETFs (VVLU, VGMF, VMIN) and is looking to expand that product range. It has also closed some funds due to lack of FUM. I was informed it also altered its fixed interest rate fund to include floating rates.

As for blogs possibly interesting but to me irrelevant same as etfwatch, Cuffelinks and the myriad of other "investment" sites which claim to provide profound wisdom. For me there is only one wisdom. Keep on investing through thick and thin.

Thank you everyone for your considered replies. I was looking at YMAX/HVST as more or less "buying an income stream" and provided the capital value didn't deteriorate it would provide much the same function as a term deposit (where face value remains constant, but erodes over time) with far superior returns. I would sleep better at night if more of my smsf liquid funds were invested out of the sharemarket, but with interest rates so low there's not a lot of options. Our main smsf asset is commercial property which we'll probably hold until/unless liquidity issues force us to sell in distant future. Our current share portfolio is varied and I'm happy to actively manage it for the present, but would prefer a more hands off approach once retired. Hopefully I'll be too busy travelling..... I don't intend to transfer all share funds into ETFs/LICs, but will probably concentrate funds to a few key holdings with low volatility such as banks and the like.

I have held STW and VTS for many years (in and out at times) and although the income is less than ymax/hvst the returns are far superior. Looking at 5 year charts for the various options STW has outperformed AFI, ARG & MLT although the distributions are not fully franked and a slightly lower return. YMAX and HVST performance is flat to negative, HVST in particular not a sensible option. I prefer the passive and lower cost style ETF over the LICs, so it seems that I'm best off to stick to what I've been doing and simply allocate more funds as they accumulate towards STW/VTS and perhaps AFI/VAS purely to spread management risk if not market risk. This has been a great discussion to help me focus my priorities, which remain capital preservation/growth. I think my personality will deal better with STW tracking the market (hopefully higher over the long term) and having to sell a small % of the holding to top up income if need be, rather than see the capital base severely underperform the market but return sufficient income.

I have held STW and VTS for many years (in and out at times) and although the income is less than ymax/hvst the returns are far superior. Looking at 5 year charts for the various options STW has outperformed AFI, ARG & MLT although the distributions are not fully franked and a slightly lower return. YMAX and HVST performance is flat to negative, HVST in particular not a sensible option. I prefer the passive and lower cost style ETF over the LICs, so it seems that I'm best off to stick to what I've been doing and simply allocate more funds as they accumulate towards STW/VTS and perhaps AFI/VAS purely to spread management risk if not market risk. This has been a great discussion to help me focus my priorities, which remain capital preservation/growth. I think my personality will deal better with STW tracking the market (hopefully higher over the long term) and having to sell a small % of the holding to top up income if need be, rather than see the capital base severely underperform the market but return sufficient income.

So many people see dividends/distributions as free money. The reality is, it all comes from an equivalent decrease in your share or ETF price. Profit is the better thing to be chasing.

Lately I've been watching a few youtube clips by Ben Felix including the following titled "The Irrelevance of Dividends"

He's not saying dividends aren't important but rather by focusing on stocks that pay dividends you are ignoring high growth ones that pay no or little dividend.

Zaxon

The voice of reason

- Joined

- 5 August 2011

- Posts

- 800

- Reactions

- 881

Exactly true. Total Return (dividends + share price growth) is all that matters. Dividends are only one part of the equation.Lately I've been watching a few youtube clips by Ben Felix

He's not saying dividends aren't important but rather by focusing on stocks that pay dividends you are ignoring high growth ones that pay no or little dividend.

I'm watched many Ben Felix videos on the past. Rarely have I found anything I disagree with him over, so he gets a big tick from me.

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,237

- Reactions

- 8,482

Lately I've been watching a few youtube clips by Ben Felix including the following titled "The Irrelevance of Dividends"

He's not saying dividends aren't important but rather by focusing on stocks that pay dividends you are ignoring high growth ones that pay no or little dividend.

Yep, it all just comes down to whether companies can deploy cash at high rates.

If a company is generating cash faster than they can intelligently invest it, they should pay dividends or buy back stock.

If they can deploy a lot of cash at high rates, they should retain earnings.

Similar threads

- Replies

- 147

- Views

- 9K