- Joined

- 8 November 2007

- Posts

- 314

- Reactions

- 0

It certainly made the dow futures dive and now the dow is in free-fall, never underestimate the power of a few stories like this to panic the market.

Remember this current rally was sparked by the rumour that a US bank might actually make a profit this quarter, yeah right

Dow down 41 points for the day and it's in free-fall? LOL

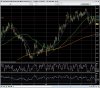

The Dow hit a low around 6,500 and now trading at 7,900, that's some dead cat indeed. Also notice that every down leg in this current run up since March has been bought into and proceeded higher, albeit now with less volume in the last few sessions. I've said it before and I'll say it again, earnings season will be what pushes this market now.