- Joined

- 29 March 2006

- Posts

- 218

- Reactions

- 0

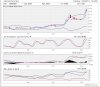

RAU looking like it's going to break up from what might be seen as a pole and pennant. Target generally considered the length of the pole from the break from the pennant. Just depends on your judgement of where the pole starts and finishes and where the break is....

(just probabilities, not certainties)

Hi Kennas, can you please explain what pole and pennant is, and what you mean by "Target generally considered the length of the pole from the break of the pennant".?