- Joined

- 2 May 2007

- Posts

- 4,737

- Reactions

- 2,992

Hi J Man

Thanks for your posting on PRU

I was off to Ningaloo Reef and excepting watching TV news occassionally was totally out of contact from Internet or phone - the best way to forget the meltdown in market . Where all the bloody top guns failed I better spend some more money on holidays before becoming bankrupt

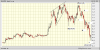

Any way the PRU shed more value from its recommendation of 79 cents as a buy. Interesting to see how market goes on Monday and probably time to buy some cheapies of PRU to make my average some respect

With market turmoil (3 trillions deficit not a joke with patch up) the gold shares are going to last longer alongwith pharma (there will be more stress, heart attacks from bank ruptcies so more medicines etc) shares

I will see today AM

Regards

Thanks for your posting on PRU

I was off to Ningaloo Reef and excepting watching TV news occassionally was totally out of contact from Internet or phone - the best way to forget the meltdown in market . Where all the bloody top guns failed I better spend some more money on holidays before becoming bankrupt

Any way the PRU shed more value from its recommendation of 79 cents as a buy. Interesting to see how market goes on Monday and probably time to buy some cheapies of PRU to make my average some respect

With market turmoil (3 trillions deficit not a joke with patch up) the gold shares are going to last longer alongwith pharma (there will be more stress, heart attacks from bank ruptcies so more medicines etc) shares

I will see today AM

Regards